Friday, January 31 2014

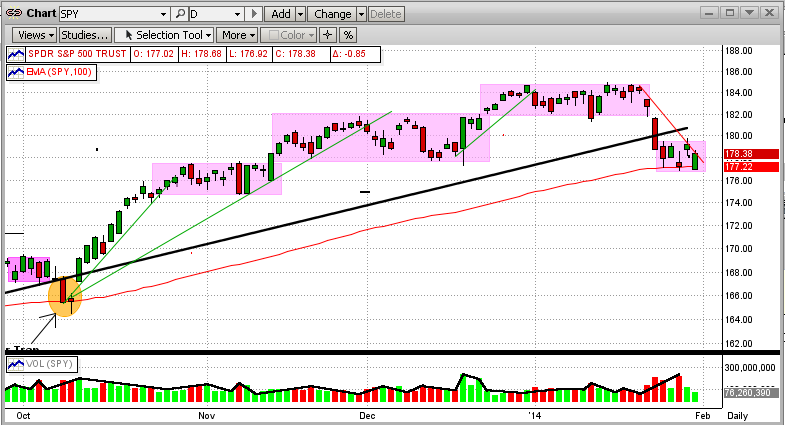

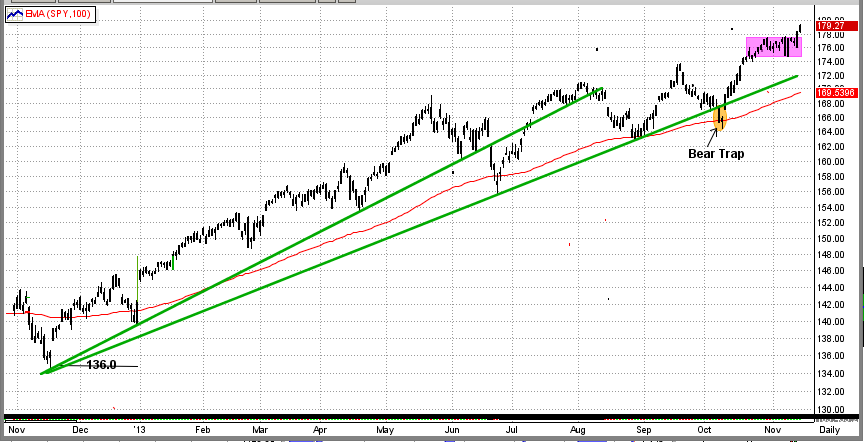

Up day, down day; three up days, three down days; etc. We have seen three multi-week sideways trading patterns in the SPY since October 2013. Then, we had a relatively big drop six days ago, followed by what is looking like another sideways trading pattern. In effect, the market has not really gone anywhere since mid-November 2013. So, is this the start of the Big One Down?

Read on... This blog is an update to a prior blog entitled "Market Crash Coming?" (see below).

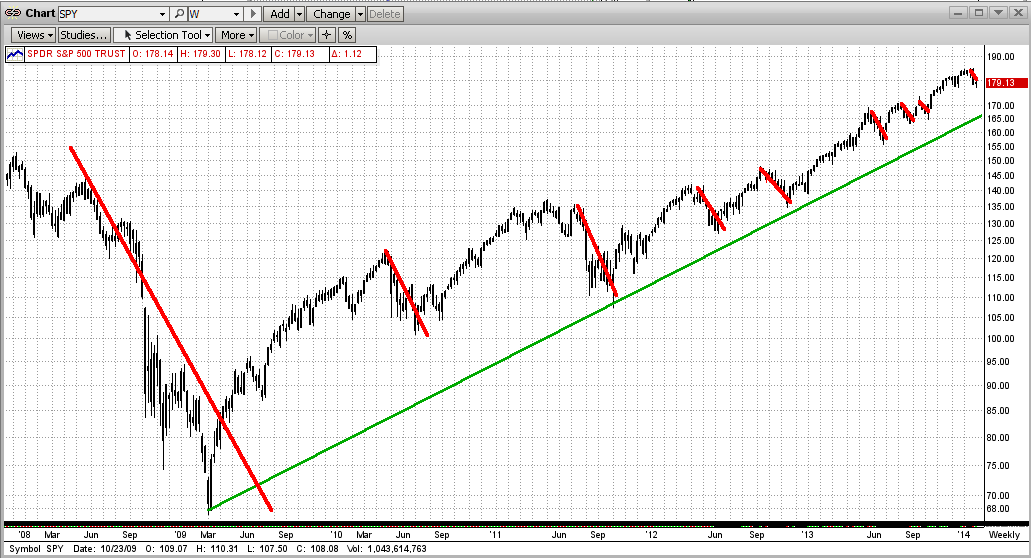

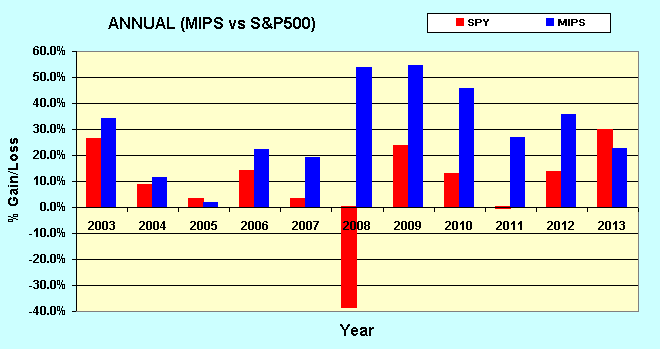

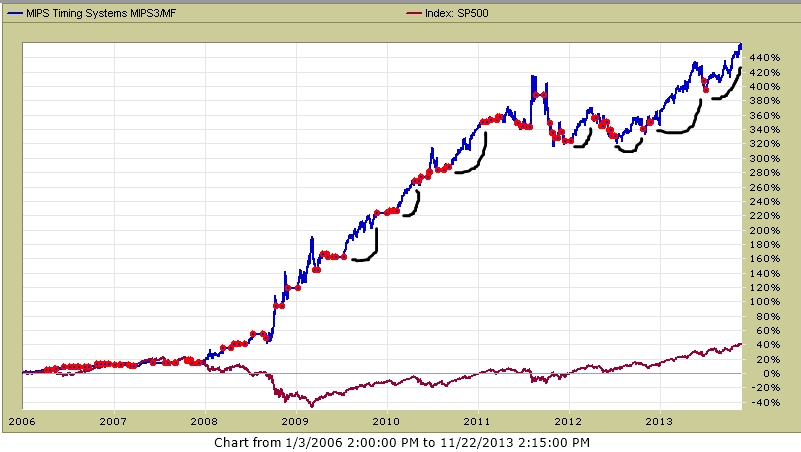

The points of our previous blog below are that: (1) the last two crashes in 2000 & 2008 took 8-9 months to develop, so the Big Ones do not normally happen quickly, and (2) when the big drop started in 2008, MIPS3 picked it up quickly and did very well for the year (MIPS3 up over 50%, SPY down over 50%).

As mentioned above, in the last few days, the SPY movements have developed into another sideways pattern, and of course, no one knows which way it will break out from here. But, the breakout is usually in the same direction that the market was heading when it went into the pattern. In this case, that means down, but the bulls are still flexing their muscles to the upside (with help from the Fed). So far this year, there has not been much harm done either way because every down day has been followed by an up day. This is not usually a recipe for a big drop, but anything can happen. Of course, MIPS is analyzing the market movements in many ways that we cannot. And, the MIPS models were developed to not "jump-the-gun" (like we might do), and make a big mistake.

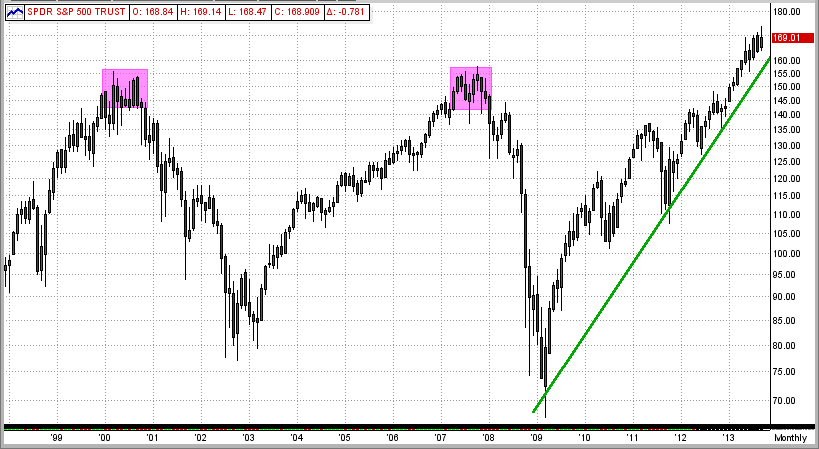

BTW, many investors are freaking out because of the market weakness in the last seven days. But,

the seemingly "big" market drop that we are seeing now is actually "tiny" once you stand back

and look at it from a long-term perspective (like over several years, as in the graph below).

Then, you can see that this year's "dip" is hardly even noticeable compared to other market "drops"

between 2007 and now.

- So, sit tight and don't panic.

- Remember, many investors lose most of their money thru panic selling, but a good "mechanical"

model should give you the confidence and discipline to "stay put" until you get another signal.

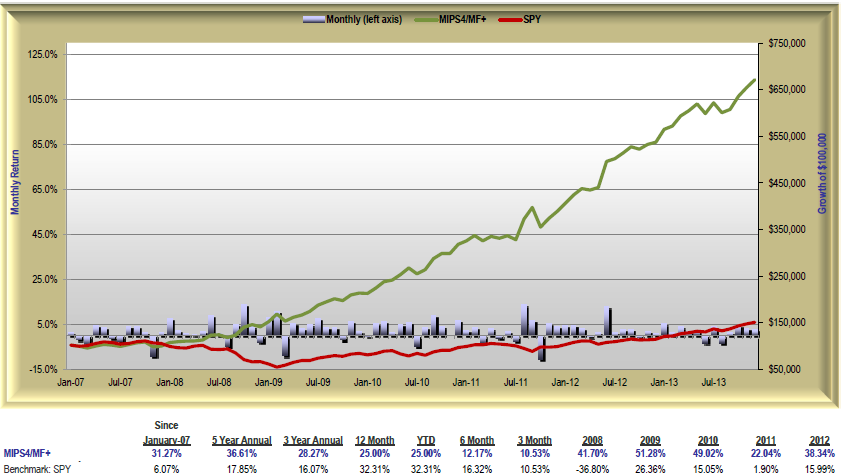

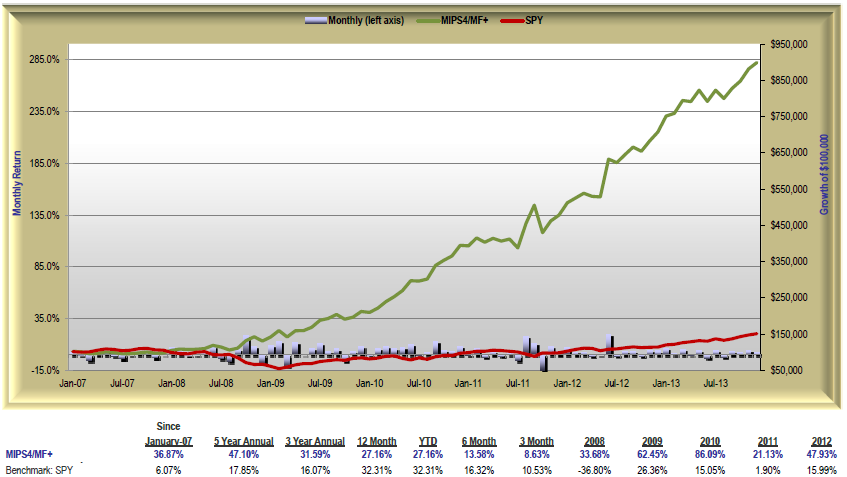

Finally, how did MIPS do in the last 11 years ???

- very well, see the MIPS4 performance below

Hope this helps !!!

===================================================================================

| Subject: |

MIPS - Market Crash Coming? |

| Date: |

Sat, 28 Sep 2013 13:42:38 -0500 |

| |

|

|

|

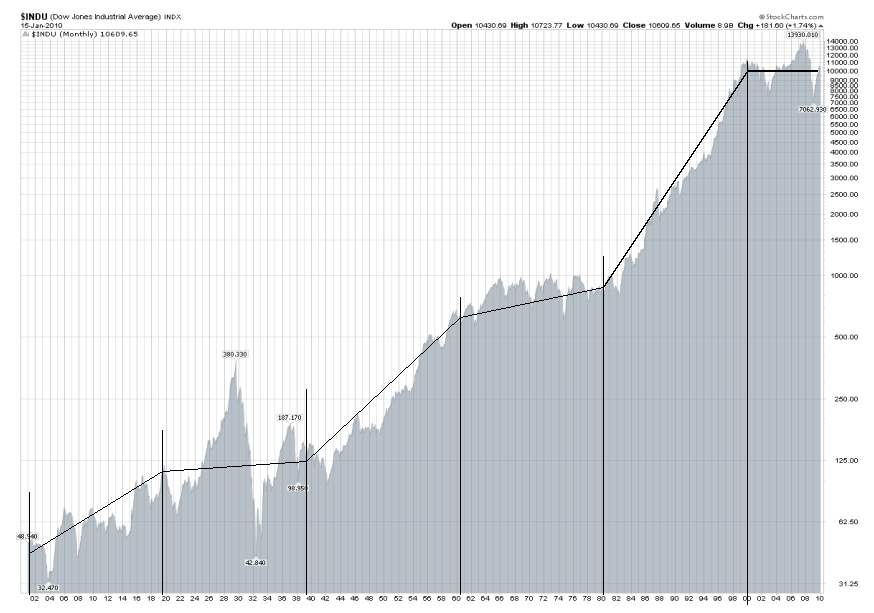

It is not really whether or not a market crash is coming, it's when. How do we know this? Because the big-bad-bear ALWAYS comes.

The very same "evidence" that Buy and Hold pundits (liars) use to prove that buy and hold works, actually proves that it does not !!! Their basic evidence is the "100 Year Dow" graph below. Upon close examination. starting with 1900-1920, you will see 20 good years followed by 20 flat/down years, over-and-over. BTW, being flat or "even" after 20 years is really a tremendous loss, because one would have doubled their money over 20 years with bonds paying only 3.6% !!!

>From the graph below it would seem that, if people lived 100 years or more, the Buy/Hold liars may have a point. But most investors' prime "equity" investment years are from the time that they are say 45 years old (bought house, kids in college, career sound, etc.) until they are 65 years old (approaching retirement, need safe investments, more money in bonds, etc.) So, the prime time span for investors having a large portion of their portfolios in equities is about 20 years.

In the last 110 years, the 20 good/bad periods were:

Good 1900-1920 1940-1960 1980-2000

Bad 1920-1940 1960-1080 2000-????

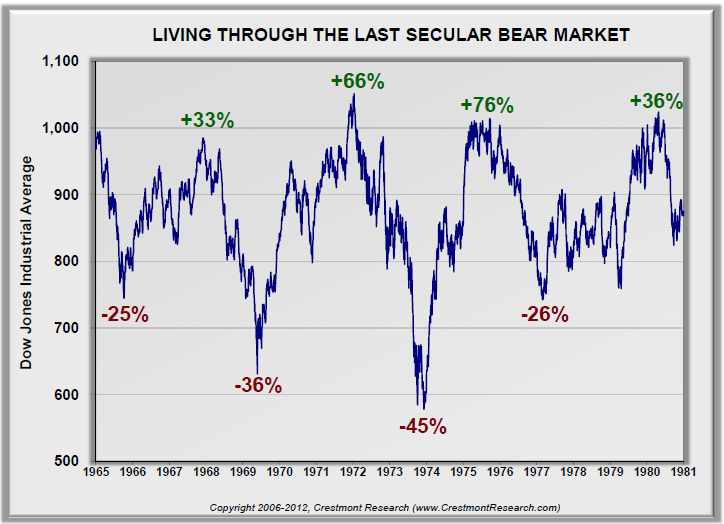

Almost everyone knows that the stock market in 1920-1940 experienced the biggest crash in the last 110 years, and we have personally "lived" through the market up/downs in 2000-2013. But, what about the market in 1960-1980? For that, see the graph below. One could say that the graph speaks for itself.

It should be obvious by now that this leaves the time period 2000-???? to dissect. Will we have another big drop? If so, when? And, how fast will the market turn down and will MIPS catch the turn? My experience has shown the market crashes that result from bad fundamentals change slowly (long bubbles like housing, etc.), whereas crashes that come from surprise "events" (like Lehman Bros.) change quickly.

See the graph between 2000-2013 below. We all know (unfortunately) that we have had two big market drops of over 50%. You will probably be relieved to see that, at the top, these markets traded in a range of (+ and -) 5% of their market tops for 8-9 months, before they headed down fast !!!

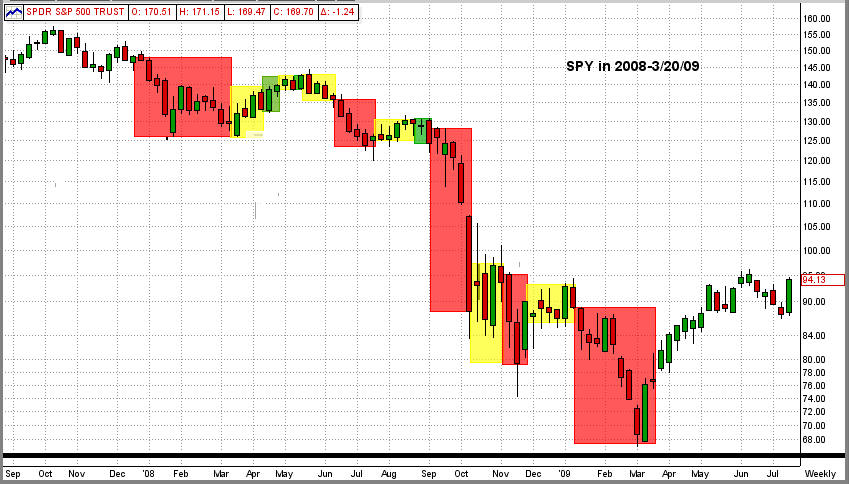

How did MIPS3/MF handle the BIG market crash of 2008?

- Well, it started with a short call on 12/12/07 for a 12% gain, followed by 4 other profitable short trades.

- Total gain of about +40% on the last 3 short trades between Sep'08 - Mar'09) !!!

- See graph below. What, me worry?

Legend: Red Boxes = Short Signals; Green Boxes = Long Signals; Yellow Boxes = Cash

|

Monday, January 20 2014

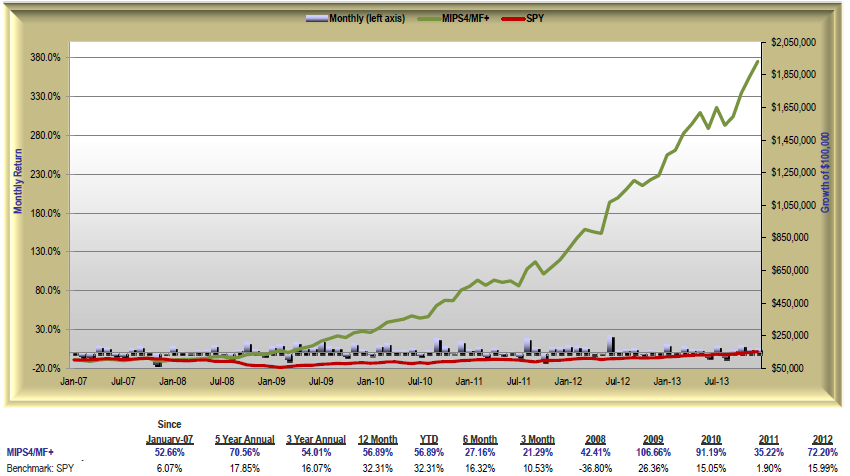

As most MIPS members already know, we show several possible trading profiles for our MIPS models under the "Services" tab on our main menu at www.mipstiming.com (and more under the "Trading Profiles" button on the Services page).

Also, I have said many times that you can trade any ETF that "correlates" well with the SPY (from Investopedia => http://www.investopedia.com/terms/c/correlation.asp ). Trading SPY/SH is the most conservative trading profile for our long/short MIPS models. However, we will show and will expand upon, more aggressive trading profiles herein.

For aggressive investors, we recommend trading a "mix" of ETFs, like 1/3 each of SPY, IWM, SSO or 1/4 each of SPY, IWM, QQQ, SSO on long signals and their respective inverse ETFs on short signals (SH, RWM, PSQ, SH*, where *SH is the single leverage inverse fund for SPY because we do not like double leverage on shorts).

See, for example, the results below from trading 1/3 each of SPY/SH, IWM/RWM, SSO/SH long/short:

BTW, on short signals, remember that your options are: (a) 1/3 each of SH, IWM, SH as in #1 below, or (b) 50% each of SH and RWM, or (c) 100% RWM, or (d) 100% SH.

I.) MIPS4/MF+ Trading SPY/SH from 2007-2013

CAGR since Jan'07 SPY=+6.1% vs. MIPS=+31.3% Max Drawdown= -10.6%

II.) MIPS4/MF+ Trading IWM/RWM from 2007-2013

CAGR since Jan'07 SPY=+6.1% vs. MIPS=+36.9% Max Drawdown= -15.1%

III.) MIPS4/MF+ Trading SSO/SH from 2007-2013

CAGR since Jan'07 SPY=+6.1% vs. MIPS=+52.7%, Max Drawdown= -16.1%

Good "mixing" to all !!!

Monday, January 20 2014

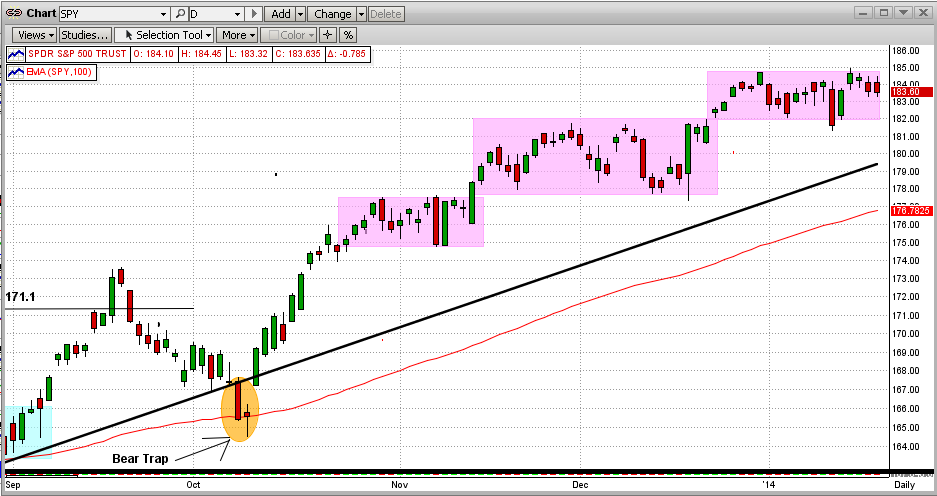

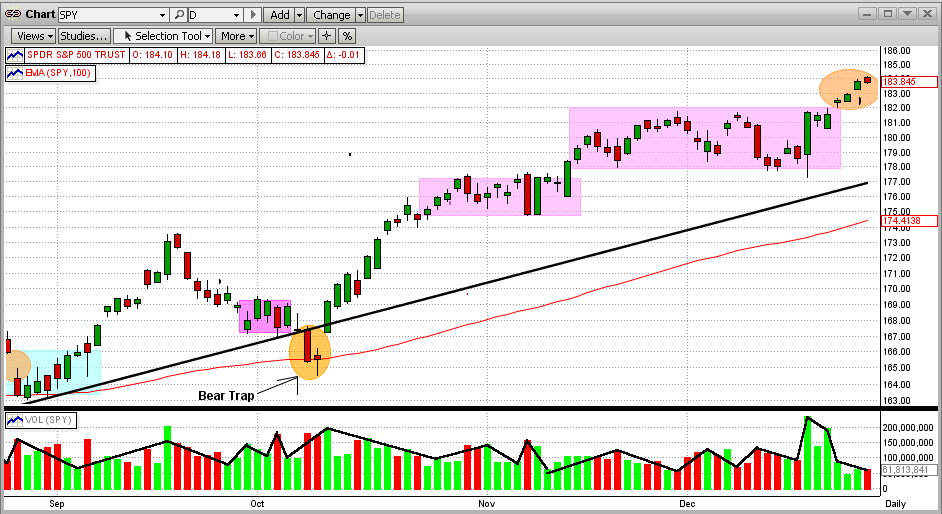

Was the market up or down in the last 4 weeks? Neither. The market (SPY) has been up and down in the last 4 weeks, three times each. The net effect was the SPY bouncing at plus and minus 0.8% around the "mean line" of about $183.36/share. Not very exciting. See the graph below.

Of course, this will not go on forever, and the SPY will once again break out of this most recent sideways trading pattern. My bet is to the upside, but no one can be sure about that. With QE3 alive and well under Yellen, being long is most likely a very good bet.

However, many indicators (both fundamental and technical) are signaling the high probability of a "correction" of at least 5-20% in 2014, but who really knows. What we can be sure of is that one day the market will take a dive that could result in another big "crash". But when? Don't know, and that is why we use MIPS.

Tuesday, January 07 2014

I would like to examine the graph below from two different perspectives. One is from the MIPS viewpoint and the other is from the perspective of how the stock market behaves at the very end of one year and the beginning of the next. The second perspective has nothing to do with the MIPS models, but it is still very interesting because it does the same thing almost every year.

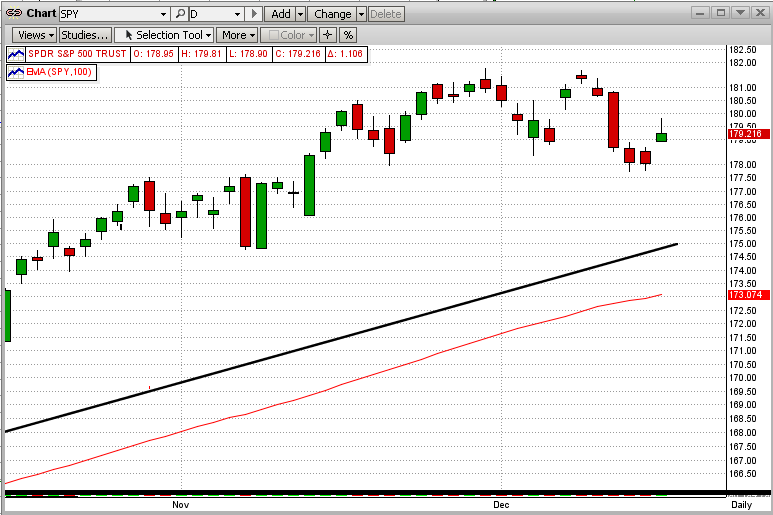

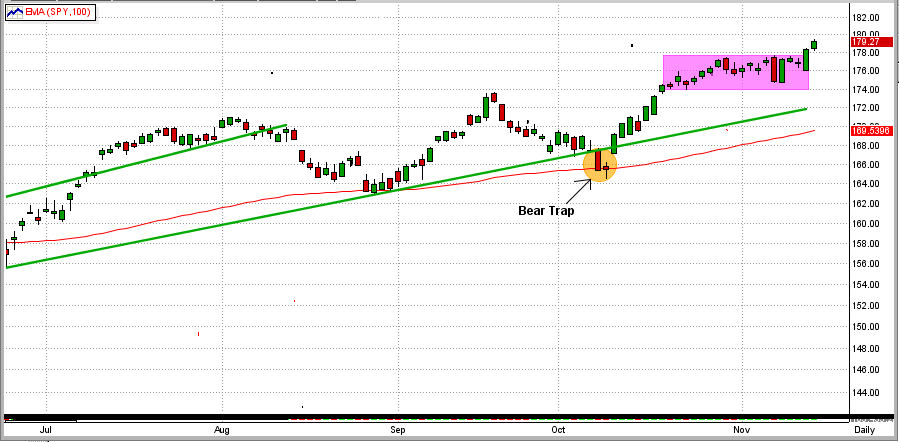

First, from the MIPS viewpoint, the graph below shows the third flat/sideways trading pattern for the SPY since the end of October 2013. In general, these sideways patterns will break out in the direction that they went in (all of the last three from the upside). The MIPS models called all of these correctly and stayed long. At this point, there is no indication of which way the SPY will break out of this new sideways trading pattern, but the odds are to the upside at this point (but, we all know that this can change in a matter of days).

Secondly, from the viewpoint of market behavior, the following phenomenon repeats time and time again.

1) The "Santa Claus Rally" is obviously a rally at the end of December. Many people feel that a major reason for this is that mutual funds buy "winners" in late December to include in their current year-end portfolio to make it appear as though they have owned these winners all year (and hence they show a portfolio of winners). This December, the SPY was up for the last seven trading days.

2) The "January Effect" is the belief (and subsequent behavior) that year-end bonuses are mostly paid in January, which leads to heavier individual buying, thus pushing the market higher. It usually works this way unless some unexpected bad news develops. However, the first few days of every January have a tendency to be down as investors dump their last-year winners to (a) protect their profits and (b) take their gains in the current year instead of in the prior year for tax reasons.

3) Watch for what is called the "January Barometer". This term results from the fact that statistically, the market performance in any given year mimics the market performance in January of that year. For example, if the market is up in January of any given year, there is roughly a 90% chance that the market will be up for that year (and vice versa, of course). This statistic is from the years 1950-2013. The saying for this is "As goes January, so goes the rest of the year".

Blog from 12/29/2013

In our previous blog below from 12/22/13, we showed how the SPY had climbed quickly back to the top of its flat/sideways trading pattern on high volume. From this one could conclude that we should have expected a "breakout" to the upside this past week. As can be seen in the graph immediately below, we did get an upside breakout this past week, but not what we would call a really strong breakout. This is mainly because of its low volume. The odds are for this breakout to pick up steam and head higher, but it could very easily turn out to be a "bull trap" that turns lower in the short term. It is exactly these kinds of situations when we need for MIPS to tell us what to do.

Blog from 12/22/2013

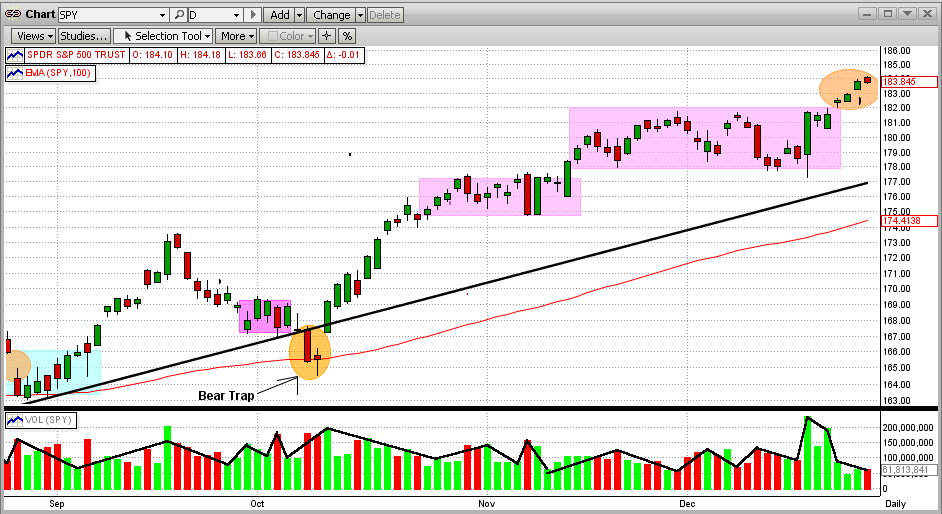

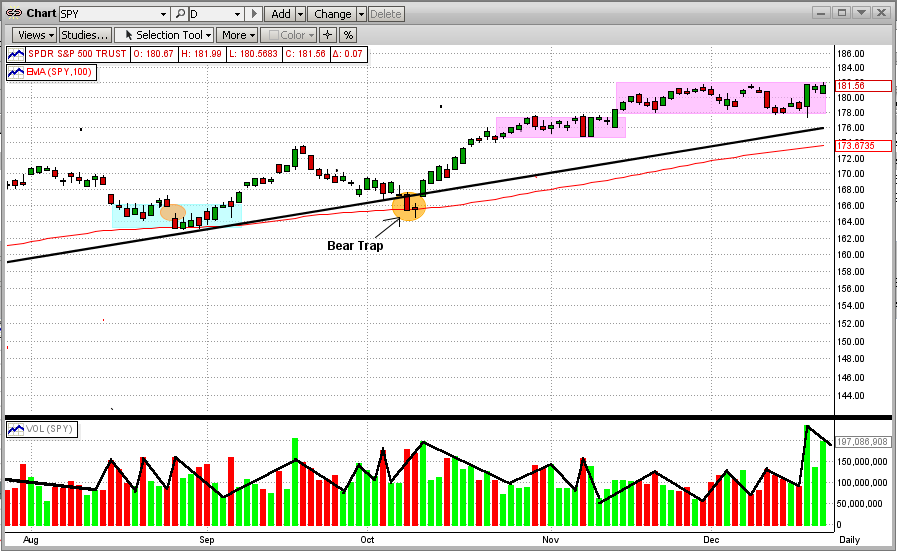

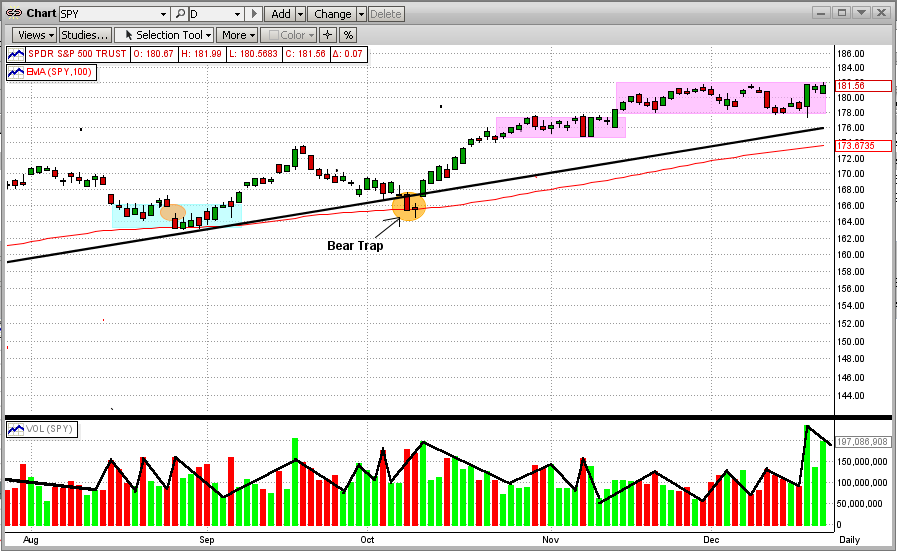

In our previous blog (from 12/16/13), we told our MIPS members to basically ignore the 5-consecutive-day drop in the SPY that occurred in the previous week (see the last graph below). The reasons for this were: (a) the entire drop was just a little over 2% and (b) the market was just completing a drop from the top to the bottom of a relatively flat/sideways 15-day trading pattern.

Then this last week, the SPY basically reversed it movement and simply went back to the top of the trading pattern (see graph immediately below). No breakout. So, is this week's move up any different than last week's move down? In many cases, the answer would be no. But, there are some compelling reasons for believing that the recent move up was indeed more telling than the previous move down, even though there was no breakout. One reason is that the trading pattern is now over 20 days old, and sideways trading patterns usually do not last much longer than that. But the BIG reason to think that this move up is different from the prior moves is that the move up was on volume almost two time higher than the volume for the prior 30 days. Thus, one can conclude that the move up was the result of the big guys buying. That's huge!!!

The real story will most likely unfold within the next week or two, so let's stay long and wait for MIPS to tell us what to do next.

Sunday, December 29 2013

In our previous blog below from 12/22/13, we showed how the SPY had climbed quickly back to the top of its flat/sideways trading pattern on high volume. From this one could conclude that we should have expected a "breakout" to the upside this past week. As can be seen in the graph immediately below, we did get an upside breakout this past week, but not what we would call a really strong breakout. This is mainly because of its low volume. The odds are for this breakout to pick up steam and head higher, but it could very easily turn out to be a "bull trap" that turns lower in the short term. It is exactly these kinds of situations when we need for MIPS to tell us what to do.

Blog from 12/22/2013

In our previous blog below (from 12/16/13), we told our MIPS members to basically ignore the 5-consecutive-day drop in the SPY that occurred in the previous week (see the last graph below). The reasons for this were: (a) the entire drop was just a little over 2% and (b) the market was just completing a drop from the top to the bottom of a relatively flat/sideways 15-day trading pattern.

Then this last week, the SPY basically reversed it movement and simply went back to the top of the trading pattern (see graph immediately below). No breakout. So, is this week's move up any different than last week's move down? In many cases, the answer would be no. But, there are some compelling reasons for believing that the recent move up was indeed more telling than the previous move down, even though there was no breakout. One reason is that the trading pattern is now over 20 days old, and sideways trading patterns usually do not last much longer than that. But the BIG reason to think that this move up is different from the prior moves is that the move up was on volume almost two time higher than the volume for the prior 30 days. Thus, one can conclude that the move up was the result of the big guys buying. That's huge!!!

The real story will most likely unfold within the next week or two, so let's stay long and wait for MIPS to tell us what to do next.

Sunday, December 22 2013

In our previous blog (from 12/16/13), we told our MIPS members to basically ignore the 5-consecutive-day drop in the SPY that occurred in the previous week (see the last graph below). The reasons for this were: (a) the entire drop was just a little over 2% and (b) the market was just completing a drop from the top to the bottom of a relatively flat/sideways 15-day trading pattern.

Then this last week, the SPY basically reversed its movement and simply went back to the top of the trading pattern (see graph immediately below). No breakout. So, is this week's move up any different than last week's move down? In many cases, the answer would be no. But, there are some compelling reasons for believing that the recent move up was indeed more telling than the previous move down, even though there was no breakout. One reason is that the trading pattern is now over 20 days old, and sideways trading patterns usually do not last much longer than that. But the BIG reason to think that this move up is different from the prior moves is that the move up was on volume almost two time higher than the volume for the prior 30 days. Thus, one can conclude that the move up was the result of the big guys buying. That's huge!!!

The real story will most likely unfold within the next week or two, so let's stay long and wait for MIPS to tell us what to do next.

Monday, December 16 2013

We at MIPS have always talked about and pointed out how the stock market moves in cycles. The MIPS models are designed to track intermediate-term cycles (like monthly cycles). But, of course, sometimes the market moves in "wiggles", not true cycles (e.g., really small day-by-day wiggles). Trying to trade wiggles leads one to much higher trading frequencies, and many times to getting whipsawed.

The last few weeks (and, in fact, several other times this year) are good examples of why one should not chase wiggles. See the graph immediately below. Looking at the market swings daily makes the changes look violent. We received many calls and emails from MIPS members last week asking what was going on in the market. Our response was "nothing that we should worry about, yet".

When we examine the market in the time frame that MIPS was designed to perform in the graph below, we now see a simple flat/sideways trading pattern, with the SPY trading plus and minus 1.13% around its mean-line value of $179.90/share. Now, that does not look so violent, and it is not violent in the context in which we are trading. These types of changes may be important to day traders that trade 5-10 times/day, but not to us. The moral of the story is for us to evaluate market moves in the context of our trading profile.

Which way the market moves from here is anybody's guess, and mine is that the market will move out of this sideways trading pattern (up or down) depending upon what the Fed says about its plans to "taper" pumping $85 billion/month in its bond-buying spree to keep interest rates artificially low. And, my guess is that the Fed will say it will not taper until 2014, and that will lift the markets. But remember, it is not what I think that matters, but what MIPS tells us.

Monday, November 25 2013

We have recently received several questions regarding the trading frequency of the MIPS models. Of course, the motivation for this is that the MIPS3/MF model has only traded twice in the last 12 months (and MIPS4/MF+ model has only traded 4 times in the same time period).

Over the last 11 years, these two MIPS models have traded an average of 10-15 times/year. But, what does that mean? It certainly does not mean that they trade once a month. A model that trades an average of 12 times/year can trade 2-4 times in some years and 18-20 times in others. And, when it does trade 12 times in one year, it can trade 3 times in one month and only once in the next 4-6 months.

The number one criteria that dictates the number of trades in any time period for a "trend following" model (like MIPS) is, of course, the time duration of the intermediate-term trends in said time period.

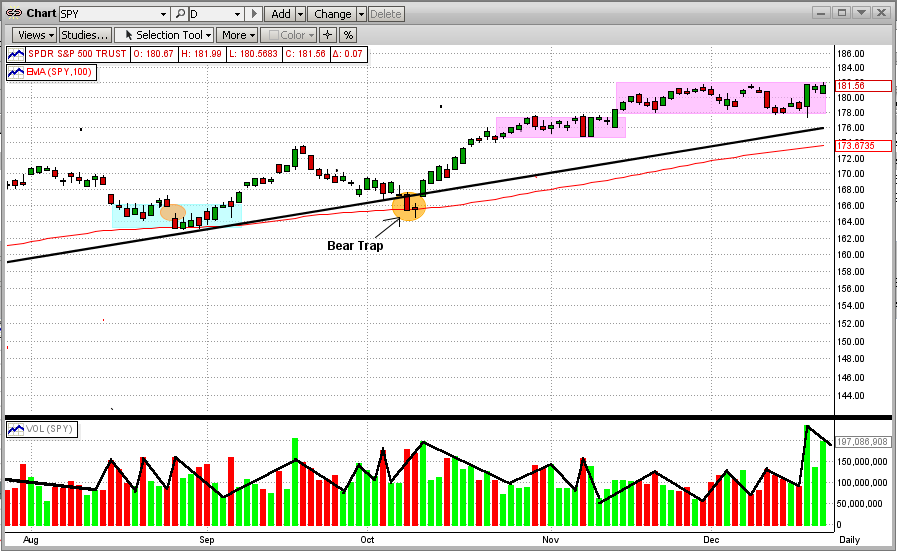

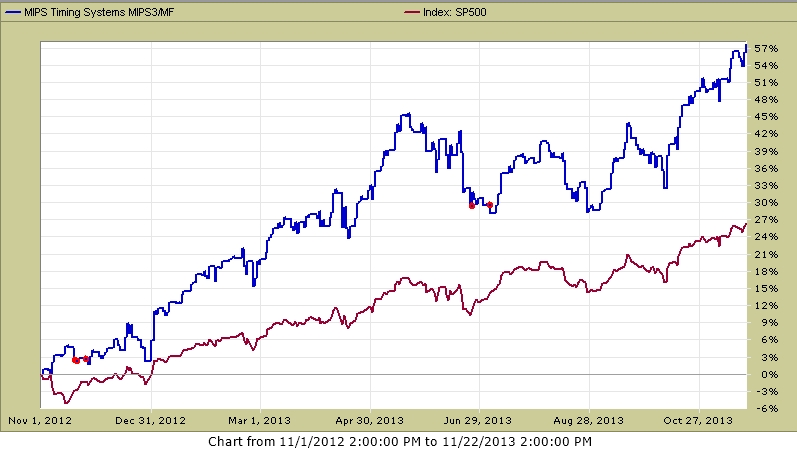

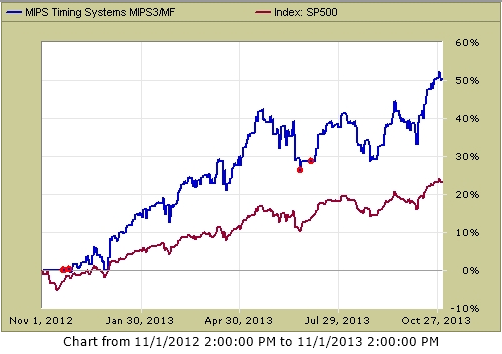

So, how does the above apply to MIPS3 and MIPS4 for 2013? To answer this question, let's look at the graph below of the SPY price action in the time frame of Nov'12 through Nov'13. In this graph, one can see the nearly perfect 12-month trendline of the SPY, and can hence understand why the MIPS3 and MIPS4 models have been long for the vast majority of this time period with very few trades. Remember, the MIPS models are following intermediate-term trends. A faster acting model would have tried to ride the shorter-term waves in the graph below, and would have traded much more often with no guarantee of better returns (but with a good chance of getting whipsawed).

SPY

LAST 12 MONTH'S PERFORMANCE (all graphs from TimerTrac.com)

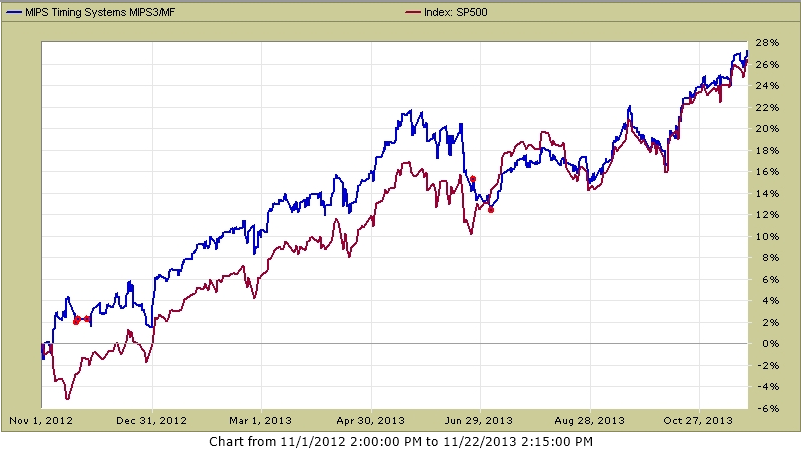

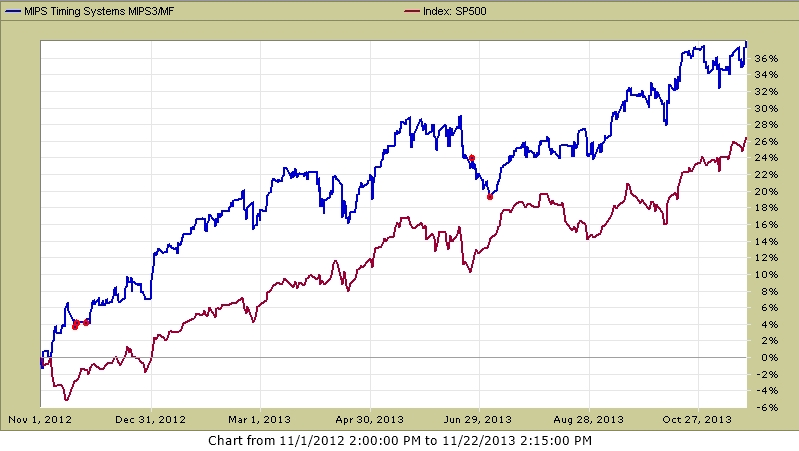

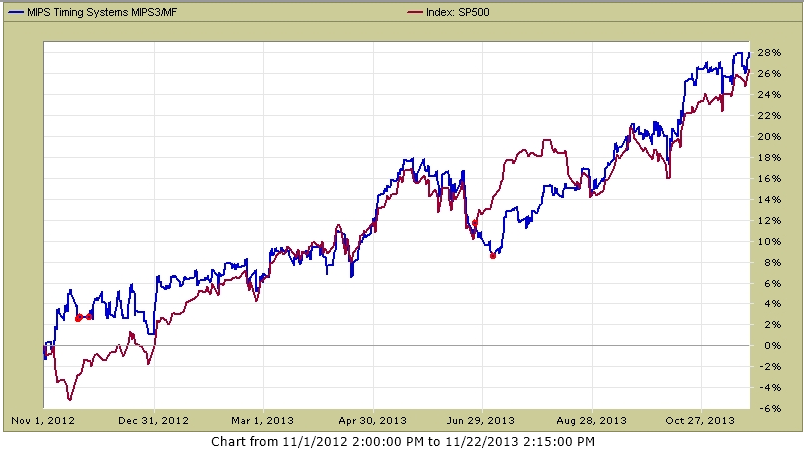

So, how did the MIPS3/MF model do in the last 12 months. We report most of our performance reports with MIPS trading the SPY long/short (or SPY long and SH short). But many of our MIPS members (including myself) trade "combos" like 1/4 each of SPY, IWM, QQQ, and SSO. See the performance of these ETFs below.

MIPS3 Trading SPY long/short

MIPS3 Trading IWM long/short

MIPS3 Trading QQQ long/short

MIPS3 Trading SSO long and SH short

PAST BEHAVIOR

Please understand that a signal with a "life" of several months (not days) is normal behavior for the MIPS models. The models will follow the intermediate-term trends (up or down) for as long as these trends continue in the same direction. The red dots in the graph below show trades for the MIPS3 model during the time period of 2003-11/20/13. It can be seen that, in this time frame, there were at least 7 times in these 11 years when a trade signal lasted 4-6 months. And, you can see that ALL of them were winning trades (long and short).

MIPS3 Trading SPY long/short

Thursday, November 14 2013

In a previous blog on April 8, 2103, we wrote about how the stock market is basically being controlled by (the actions of) one man - Ben Bernanke. This, of course, has everything to do with his printing more and more of your money, to the tune of $85 Billion every month (that's over $1 Trillion/year) !!! And, the Fed continues to do so. The point of the previous blog (and this one) was that it is very hard for the market to go down with this kind of money working to keep interest rates low. Remember the #1 rule in stock investing - "Don't fight the Fed." Of course, with low interest rates, money naturally funnels its way out of bonds and into stocks (and there is a lot of money in the bond market, like about 5 times that in the stock market).

At any rate, after trading in a tight sideways pattern for over 3 weeks, the SPY broke to the upside yesterday (Wednesday) and again today. See graph blow.

Also, as expected, the long-term upside trend continues from all the way back in November 2012 (see the long trend lines in the graph below). Again, this is no surprise with the Fed's extensive QE3 "program" (if you want to call it that). When (and if) this comes to an end, it most likely won't be pretty.

Of course, this long, relatively smooth up-trend is the reason that the MIPS models have not traded very often between late 2012 and thru Nov 14, 2013. We will wait for MIPS to tell us when the party is over.

Sunday, November 03 2013

When trading double leverage ETFs (like for the SPY, IWM, QQQ, etc), we recommend:

(1) trading double leverage on long signals and single leverage on short signals, or

(2) simpy trading double leverage long only.

Here is how MIPS3/MF performed trading double leverage SPY (SSO) long only over the last 12 months.

SPY +23.4% SSO Long Only +50.5%

|