Sunday, April 26 2015

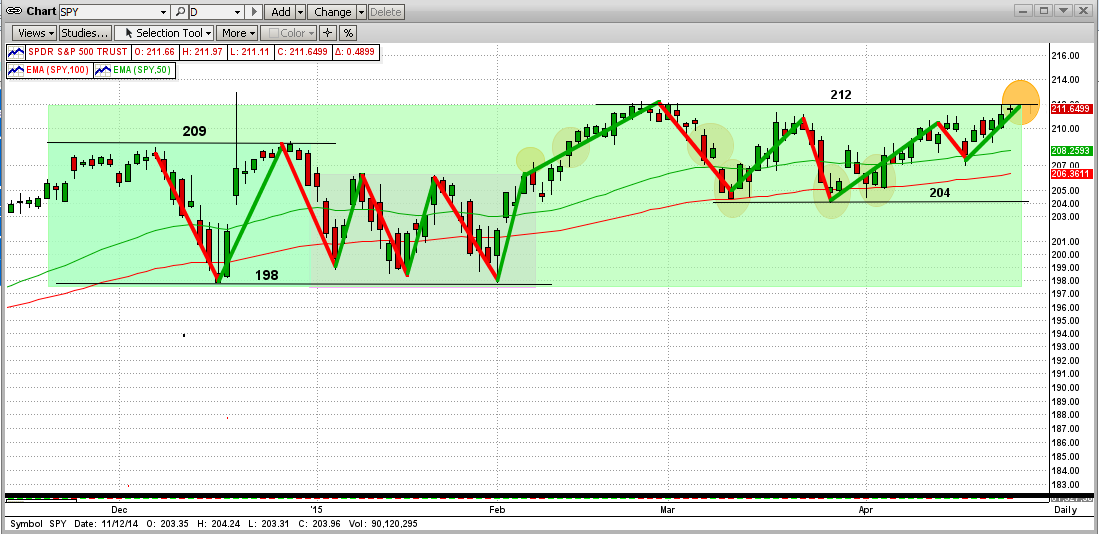

As most of you know, this market has been "flat" and going nowhere for over 5 months now (see our previous blog and the updated graph immediately below).

We all know that a market that stays flat for 5 MONTHS is really "long-in-the-tooth". Flat markets simply DO NOT last much longer than this. Why? Because $ trillions have changed hands (aka "traded") and the market has changed less than 3% !!!

Usually, in these types of flat markets:

1) the market breaks out in the same direction that it came in,

2) the longer the market stays sideways, the bigger the breakout.

Since these types of markets result from universal uncertainty, a major "catalyst" is necessary to inspire one side or the other to move with force (and then, the other side simply gives up and joins the newly formed trend). From where we are today, I see Apple as that catalyst. After the close on Monday, Apple will announce their earnings and offer their guidance for the near-term future. So, Tuesday could be a BIG day for the US markets. But, the large/institutional investors that know what Apple is going to say could also influence the market in Monday's trading.

Remember, above $212 on the SPY is "new high" territory !!!

I personally believe that we will break to the updside. This is just my opinion, not that of MIPS. We can believe what we want, but let's wait for MIPS to tell us what to do going forward. Stay tuned...

===========================================================================

<<< Previous Blog >>>

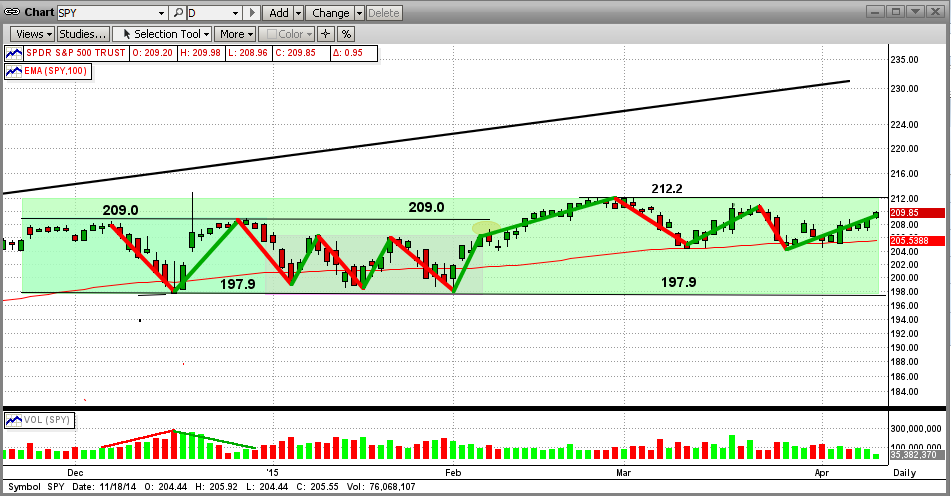

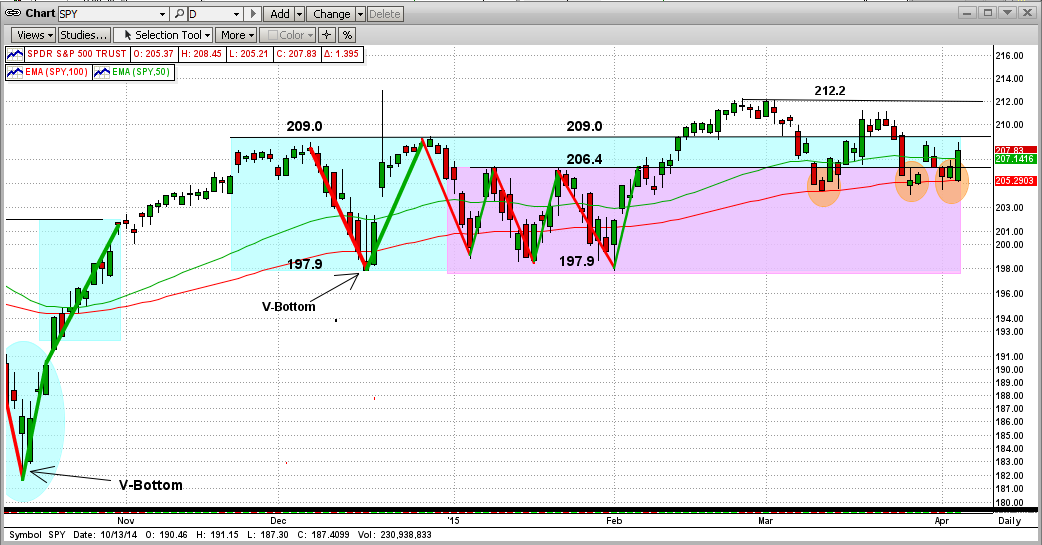

Talk about "A Market Going Nowhere, Fast" - you have just witnessed one. For the last FIVE MONTHS, the SPY has traded in a rather tight trading range of plus-and-minus 3.5% around the mid-line of a price range between 197.9 and 212.2 (see graph below). And, the SPY has experienced 12 short-term trend changes in this time period (if you can call them that). Even more remarkable is that, with all of these "wild" changes, the SPY on 3/31/15 was only 0.43% higher than it was on 12/31/14.

This has been a VERY volatile market. For example, the Dow experienced 16 days of triple-digit moves in March alone (that's 16 triple-digit days out of 22 trading days, or 73% of the days). These 16 triple-digit days accounted for 3,149 "swing" points for the Dow, and yet it closed less than 2% higher for the month.

The stock market continually experiences flat or sideways markets (aka "consolidation patterns"), but they rarely last 5 months. This one is long in the tooth. The stats show that: (a) most of the time the market breaks out of the pattern in the direction from which it came in (up in our case) and (b) the longer the time frame of the sideways pattern, the bigger the following breakout move is.

Obviously, this market has no short-term trend or direction now (other than flat-as-a-pancake), but the long-term trend is still up. The next few days are vital. In order for the bulls to keep running, the SPY must break above the strong resistance at 212.2 (its all-time high) with some degree of strength. If that does not happen in a relatively short period of time, the bears may get rejuvenated and may finally push this market down big, at least a "correction" if not the "big one".

One positive aspect of a long-term sideways pattern is that MIPS usually gets set to "trigger" faster after being "flat" for over 100 days (think of what that does to 20-50-100 day EMAs). Because of moves like this (of lack thereof), a small change can look big to MIPS after months of plus-and-minus 3%.

Until further notice, we are still bullish, mainly because the long-term trend is still up. No matter what, we will be waiting for the MIPS models to provide our future guidance (as usual). Stay tuned...

Thursday, April 16 2015

Press ? for keyboard shortcuts.

As you know, the MIPS models trade an "average" of about 12 times/year. Of course, this means that the models can trade as many as 16-20 times in some years (like 2008-2009-2010) or as few as 2-4 times in other years (like 2013-2014). This is not by design, it depends upon the number of trend changes (and the volatility) in a given year.

At any rate, we have many MIPS members now who like to trade more often with the MIPS signals. On our website, we have always offered traditional trading ideas under the "services" tab in our main menu. This includes trading ETFs like the SPY, IWM, QQQ, etc., on long signals and their shorts or inverse funds on short signals. We recommend that our traders include a large percentage of SPY in any of their trading profiles because this is what MIPS is based upon. But, a little of the others (up to 50%) is OK. And, for more aggressive investors, we also approve of using some leverage. Our favorite is being long 1.5x SPY on long signals and being short 1.0x SPY on short signals (we do this by investing 50% in SPY and 50% in SSO on long signals, and 100% SH on short signals).

MIPS models (MIPS1, MIPS2, MIPS3 and MIPS4)

Our "Services" section covers the above in detail, and it explains the pros and cons of trading with any of the MIPS trading models. Basically, we highly recommend MIPS4 because it is our newest, best model trading ETF funds on the "next day's Open". But, if you must trade on the "next day's Close" (as in many 401K accounts), we recommend that you use MIPS3. You would only use MIPS2 if you can can't trade (or do not want to trade) over about 6 times/year. Use MIPS1 only if you can trade only 1-2 times/year (not recommended, but still better than buy-and-hold).

FOR AGGRESSIVE TRADERS THAT WANT TO TRADE MORE OFTEN and do not mind some extra effort on their part, we have added a new section to our "Services" page called "AGGRESSIVE TRADING" (this has been added as a blue "button" on the top left of our "Services" page www.mipstiming.com/services ).

Or, YOU CAN READ EXCERPTS OF IT HERE...

STRATEGIC and HIGHER-FREQUENCY TRADING

Even though we DO NOT recommend the strategies below for the average investor, active investors and day traders have shared with us what they have done to produce great results, either by taking more risk or working harder to prepare for higher frequency trades. IN ALL CASES THEY ARE RELYING ON THE MIPS MODELS TO PROVIDE THEM WITH THE DIRECTION OF THE MARKET (and it has done so correctly 65--70% of the time in the last 9 years). Many times, these investors are managing only a portion of their MIPS money with the strategies below, and the rest with the recommended MIPS trading profiles in the "Services" section.

Higher Frequency Trading For Long/Short Investors:

1) Aggressive investors trade more leverage than 1.5x SPY. They may trade:

a) Double leverage (2x) long/short.

b) Triple leverage (3x) long/short (not recommended).

c) Double (2x) or triple (3x) leverage long and single leverage (1x) short.

2) Use the MIPS trends to trade options, futures, etc., "on the money", and renew them until the current trend changes

direction.

3) Follow the trend with MIPS, and rotate "high momentum" individual stocks:

a) Use a "stock screener" (Morningstar, VectorVest, Omni-Trader, etc.) to identify the best 5-10 top performing stocks,

buy them on long signals, and rotate them every day or week or month, depending on how often you want to trade.

b) Ditto the above to short the worst 5-10 performing stocks on short signals, and rotate them every day or week or

month.

4) Ditto #2 immediately above, but with "high momentum" ETFs instead of with individual stocks.

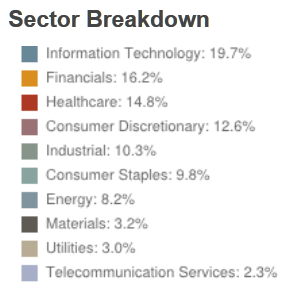

5) Trade the "hottest sectors" in the S&P 500 (instead of all sectors, which are included in the Index and the SPY):

a) On long signals, buy the top performing 3-4 S&P 500 Sectors (like maybe technology, health care, financials, etc.),

and rotate them every week or month.

b) on short signals, short the worst performing 3-4 S&P 500 Sectors (like maybe energy, industrial, materials), and

rotate them every week or month.

6) Most of us know Pareto's Principle as the 80-20% Rule. It implies that, in general, 80% of the effects come

from 20% of the causes (Google it). For the stock market, Marty Chenard from www.stocktiming.com coined

the 70-20-10% Rule. He proposed that 70% of your success in trading depends upon your trades being

"in sync" with market movements/trends (long in up markets, etc.); 20% depends upon you being in the right

sectors at the right time; and the remaining 10% depends upon the stocks that you buy in these sectors.

To implement this methodology, we propose that you follow the steps below:

i.) MIPS - the first part of your success should come from MIPS correctly identifying up/down trends

(you want to be long on uptrends; short on downtrends; and in cash on flat/sideways trends).

ii.) Hot Sectors in #5 above - The second part should come from your picks of the top 2-3 Hot Sectors as described, and

iii) High Momentum Stocks/ETFs in #3 or #4 above - The last part should come from trading the top 2-3 "High Momentum"

stocks or ETFs in each sector from ii.) above.

Of course, in down markets, you would do the inverse (look for the worst sectors, stocks, ETFs).

--------------------

Many of the above strategies can greatly increase the number of trades with MIPS signals without violating the trend. If MIPS identifies the trends correctly (which it has done very well in the last 9 years), and if MIPS members are willing to put in the extra effort, they could possibly make more $'s with the above trading strategies than by simply holding 1-3 positions (long or short) the entire signal life of every trade.

We do not track or report the performance of any of the above strategies.

Sunday, April 12 2015

Press ? for keyboard shortcuts.

Talk about "A Market Going Nowhere, Fast" - you have just witnessed one. For the last FIVE MONTHS, the SPY has traded in a rather tight trading range of plus-and-minus 3.5% around the mid-line of a price range between 197.9 and 212.2 (see graph below). And, the SPY has experienced 12 short-term trend changes in this time period (if you can call them that). Even more remarkable is that, with all of these "wild" changes, the SPY on 3/31/15 was only 0.43% higher than it was on 12/31/14.

This has been a VERY volatile market. For example, the Dow experienced 16 days of triple-digit moves in March alone (that's 16 triple-digit days out of 22 trading days, or 73% of the days). These 16 triple-digit days accounted for 3,149 "swing" points for the Dow, and yet it closed less than 2% higher for the month.

The stock market continually experiences flat or sideways markets (aka "consolidation patterns"), but they rarely last 5 months. This one is long in the tooth. The stats show that: (a) most of the time the market breaks out of the pattern in the direction from which it came in (up in our case) and (b) the longer the time frame of the sideways pattern, the bigger the following breakout move is.

Obviously, this market has no short-term trend or direction now (other than flat-as-a-pancake), but the long-term trend is still up. The next few days are vital. In order for the bulls to keep running, the SPY must break above the strong resistance at 212.2 (its all-time high) with some degree of strength. If that does not happen in a relatively short period of time, the bears may get rejuvenated and may finally push this market down big, at least a "correction" if not the "big one".

One positive aspect of a long-term sideways pattern is that MIPS usually gets set to "trigger" faster after being "flat" for over 100 days (think of what that does to 20-50-100 day EMAs). Because of moves like this (or lack thereof), a small change can look big to MIPS after months of plus-and-minus 3%.

Until further notice, we are still bullish, mainly because the long-term trend is still up. No matter what, we will be waiting for the MIPS models to provide our future guidance (as usual). Stay tuned...

Tuesday, April 07 2015

Press ? for keyboard shortcuts.

Here we go again... "Bad Economic News = Good Market News"

Getting kind of old, isn't it? But, at least, it is very predictable.

Again, with the terrible new jobs report, the market reacted to what it thought Aunt Janet would think, instead of the ramifications of the bad news on our economy. This can't go on forever, but it can as long as the Fed supports it. Remember, the Fat Kats like the Fed's free money (actually our money); and they will do whatever they can to keep it rolling, like supporting the up market up to make Yellen look good and to keep her in line.

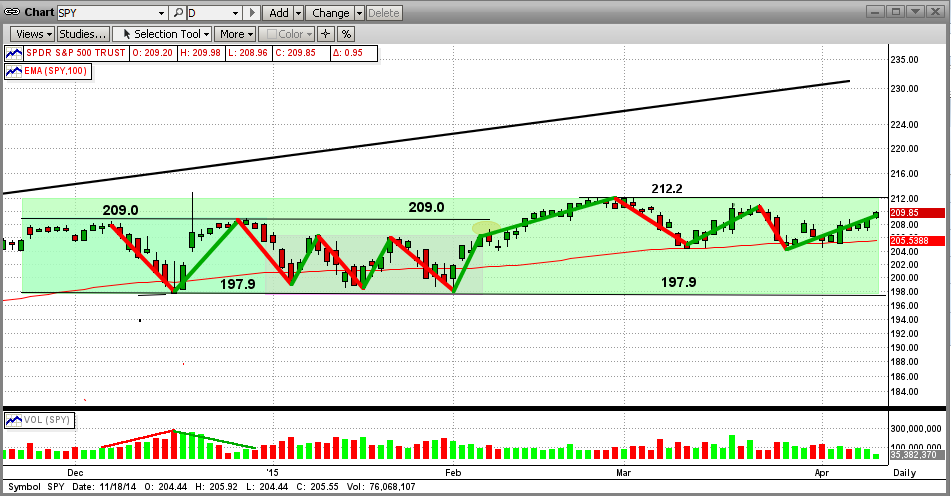

The good news for us is that the SPY bounced off of its 100-day EMA to the upside again today. See the orange ellipses in the graph below. This is the 3rd time this has happened in the last 3 weeks, but this will not continue to go on much longer.

If the SPY is going to break out of its very long "No-Man's-Land" pattern at 209, and challenge its all time high at 212.2 again, it needs to keeps going up from here. A fail here would not be good. I think that it will, but I trust MIPS' guidance much more than my own. So, we wait again. Stay tuned...

Press ? for keyboard shortcuts.

<<< Previous Blog >>>

The only good news that I could muster up out of the last 2-3 weeks of "market noise" was that:

1) the Fed is still "dovish" with regard to raising interest rates,

2) the Fed still "rules",

3) relatively low volume says that it was not the Fat Kats causing last week's minor sell-off,

4) the SPY closed up above its 100-day EMA in the last two "attacks", and

5) this sideways trading pattern is getting "long in the tooth".

From this, one could expect a market bounce-back going forward, if not an SPY run-up to above $209. But, of course, it's anybody's guess from here, so let's simply follow MIPS' advice. Stay tuned !!!

BTW, these "sideways trading patterns" do not last forever. Many times, they break out in the same direction that they went in (up, in this case). And, the longer the time in a sideways pattern, the bigger the market move after the breakout.

|