Saturday, February 29 2020

2016

Red - SPY

Blue - MIPS3

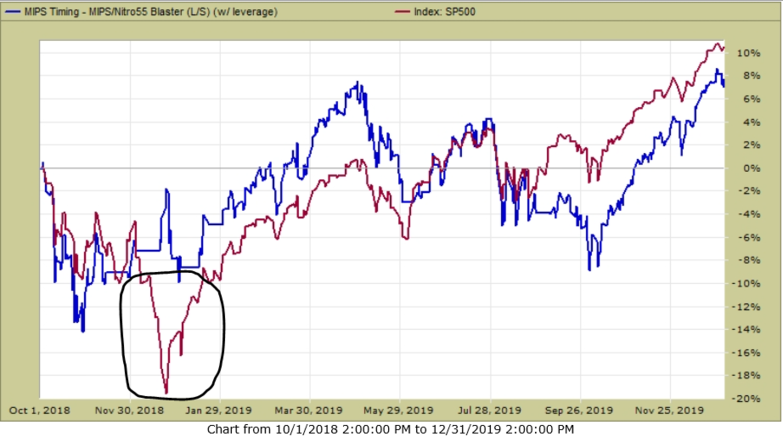

2018-19

Red - SPY

Blue - MIPS3

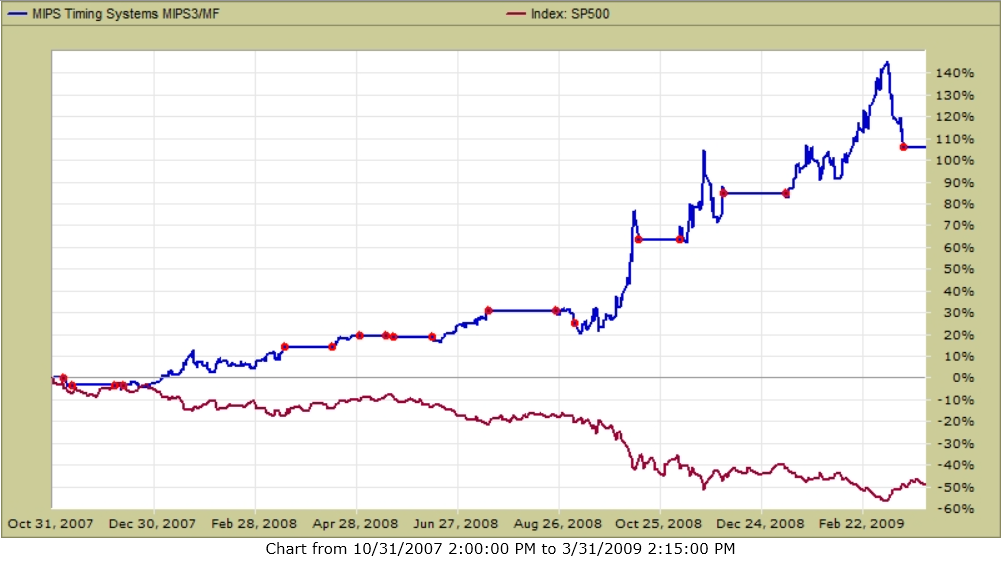

2008 - Between Oct 2007 and March 2009, MIPS3 was up +138% when the SPY hit its -55% low !!!

Red - SPY

Blue - MIPS3

Now, here we are 10+ years later, with a strong bull market and with still very good economic conditions; but who knows what's next. Most likely the next big moves in the market will be determined by the following "conditions":

- the COVID_19 virus,

- the inverted bond market,

- a highly over-bought stock market (high P/E ratios),

- the 2020 elections, and

- recession fears.

This is why we need MIPS to keep us out of trouble.

- if this market becomes a bear market, MIPS will make money like it did in 2008 (but most likely not that much);

and if it becomes a V-Bottom, MIPS should ride it back to where it started.

- But, of course, in either market MIPS could be whipsawed (not likely)

- MIPS3 is a very good model, but MIPS/Nitro is better !!!

Paul Distefano, PhD

CEO / Founder

MIPS Timing Systems, LLC

Houston, TX

Monday, February 24 2020

Today was the worst day in the stock market in quite a while. It is not often that the Dow drops 1,000 points and the S&P 500

drops over 100 points in one day.

Many times, large daily drops in the market result from rumors or fake news, and the negativity does not last long. But, this time,

there are two good reasons behind this big drop. One is the Coronavirus from China (and spreading) and the "inverted" interest

rate curve (i.e., where the interest rate on 3-month bonds are higher than the rates on 10-year bonds). If this virus spreads like it

could, production and trade would suffer all over the world quickly. And, if the interest rates stay inverted, the Fed could be forced

to lower rates, possibly even to zero or negative. The many awful implications of these two "reasons" are way too broad to cover

in this blog, but you can find readings about these all over the Internet.

For now, let's see how worried you should be about this drop (and future drops) at the time. First, let's see how bad today's drop

really was. Of course, a drop like today is short-term bad no matter what, but not really bad when compared to recent gains. In

mathematics this could be referred to as "relativity"; where a 3% drop in one day in a market that has grown 25-30% in the last

12 months is actually not nearly as bad as a market that has dropped 3% in one that had grown only like 6% in the last 12 months.

Graph #1 immediately show us what today's market looks like after today, and Graph #2 shows us what this looks like after

stepping back and looking at the graph from afar (like seeing a forest fire from a helicopter instead from inside the fire itself).

Graph #1

Graph #2 is the same as Graph #1, but when you step back and put it in perspective as in Graph #2, the situation does not look

as horrific as you thought (and this may keep you from panicking like an amateur).

Graph #2

Of course, the may not be the end of this mess

All of the MIPS models are still Long, but the upside support in the model is getting weaker .

DON'T Panic - This may not be the end of this mess, but we have MIPS to tell us what to do.

Paul Distefano, PhD

CEO / Founder

MIPS Timing Systems, LLC

Houston, TX

281-251-MIPS(6477)

Tuesday, January 07 2020

Note: In this article, the "market" is the ETF for the S&P 500 Index, the SPY

As we all know by now, the stock market has been almost flat since Jan'18 (but with a good up kick in 4Q'19). In many years, the market goes up in the 4th Quarter, mainly because mutual funds are selling their annual losers and replacing them with many of the hottest stocks of the year. The "rats" are doing this so that their year-end portfolios look like they had owned the "hotties" for most of the year.

As a mathematical model, MIPS was designed to basically "keep-up" with (or slightly beat) the market in up markets, and to beat the SPY dramatically (and make big bucks) in down markets. BTW, those that want to beat the SPY in up markets should consider at least a little leverage; like 1.25x leverage in the SPY on Long Signals (go long with 75% SPY and 25% SSO); but only 1.0x leverage on Short Signals (100% SH).

Given the above, here is how MIPS performed since Oct'18:

- please note that MIPS avoided the big dip in 4Q'18

- the models that performed the best in 2019 were the ones that lost the most in the 2018.

>From here, of course, the market can go anywhere. In general, unless a bull market gets greatly "overbought", it will continue up until corporate profits go south and we reach the next recession. Other than 10-15% "corrections", markets DO NOT drop when corporate profits are healthy.

Along the way, however, the market is disturbed by dramatic events (Brexit, international trade setbacks, etc.). The big Institutional Investors ("fat kats") like volatile markets because they buy at the bottoms and sell to the little guys at the tops. It is hard for us to predict the tops and bottoms, but it is very easy for the fat kats to do so because they basically "cause" them to milk the little guys.

Market Crashes

At this time it is hard to predict a market crash, as it will take a big catalyst (the Fed, Impeachment, etc.) to turn the bull. But, over time, the big crash will come. When it does, you want to be following a model that is good in market crashes and that is where MIPS is by far "the best". Below, you will see the actual MIPS3 performance in the 2008 crash (buy/sell/cash signals verified by TimerTrac.com since 11/04/2005).

MIPS - in 2008 Crash

Market Crash (4Q'07 - 1Q'09)

MIPS (blue) +108%

SPY (red) - 50%

From TimerTrac.com (red dots show trades)

PLEASE

Do not try this yourself, follow MIPS (the top ranked model on TimerTrac.com since 2007).

Paul Distefano, PhD

MIPS Timing Systems, LLC

Houston, TX

www.mipstiming.com

281-251-MIPS(6477)

Tuesday, November 05 2019

Well, well, well... The market (S&P 500) hit another new high this week. The reason "given" for this by the press is that the economy continues to improve as indicated from the jobs report this week (showed more jobs created than expected). Of course, "the press" will release any news (or any reason behind it) that flies, if people fall for it (true or not).

See the graph immediately below and continue reading below that....

As you can see in the graph above, from a quantitative view two things are possible:

I.) A market top is showing itself in the form of a "Triple Top", or

II.) More new-highs are expected as indicated by the "upside breakout" after the 3rd try in the

last 3 months.

EXPLANATIONS

I.) The "triple top" is sometimes one of the best indicators showing a market that is getting ready to turn around and head south. It seems to me that this is not the case now, although there could be arguments regarding overbought stocks, high P/E ratios, etc. But, it is not because (as the press is pushing) the "time has come" for the market to let out steam (aka "crash").

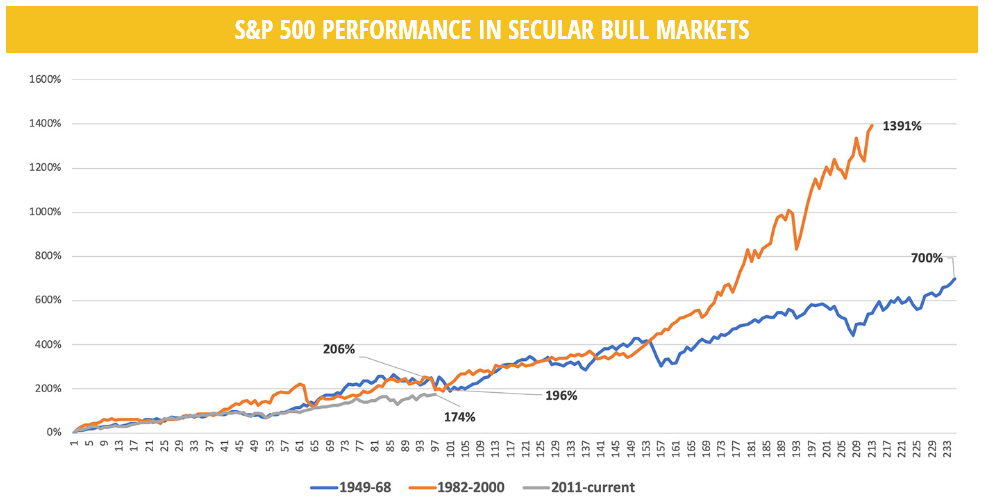

II.) Regarding the last sentence above, we do not believe that the "time has come" for the market to take a big drop. The press should look to find other reasons because there have been several other almost 20 year "runs" in the stock market since 1950, thus having lasted about TWICE as long as the "run" that we are in now. In the graph below (from Proactive Advisor magazine), you can see that "Bull Runs" have lasted 19 years in "1949-1968" (orange line) and 18 years in "1982-2000" (blue line). You can also see that after 8 years in this bull market of "2011-current" (gray line), the up-trend has been in existence for about 100 months, but it still has plenty of time to grow without having to break any "time" records.

Ok, ok... Good cases for both of the above, so "what's next"?

The "what's next" is out of my personal ability (and yours). But, I have programmed the MIPS models with sophisticated mathematics to tell us what to do, and you and I personally are not going to beat that. In fact, MIPS3 is the top model on TimerTrac.com (#1 tracking company) for performance between 2007-2019 ytd. MIPS follows the S&P 500 index (to buy or sell) kind of like the software in a F-35 fighter jet follows an enemy fighter jet (to live or die). BTW, you step into that type of arena every time you travel on a commercial aircraft (autopilot), drive a car, etc.

So, follow MIPS in the future !!!

Good trading !!!

Paul Distefano, PhD

MIPS Timing Systems, LLC

Houston, TX

281-251-MIPS(6477)

408-234-8348 (Cell)

Monday, October 28 2019

After all of the "good news" in the last two years (low unemployment, higher corporate profits, etc.), the S&P 500 ETF (SPX) made an All-Time New High today (10/28/2019). See the "Upside Breakout" on the top right in the graph below.

As you can see in the graph immediately below, the "ride" in 2018-19 has been a rocky one, with V-Bottoms, Zig-Zag, and Sideways Markets almost everywhere. It might not be obvious, but it is extremely difficult for quant models to maneuver through patterns like those below without getting whipsawed. In spite of all of this, the S&P 500 has managed a 13.6% gain so far in these last two years.

A "cleaner" way to look at the SPX over these two years is to back up and look at the same time frame with Weekly bars (below) instead of Daily bars (above). With a "higher view", the patterns become easier to see and read.

What's Next ???

The dangerous part of all Blogs regarding the stock market (or everything else for that matter) is trying to predict the future. From my view point (not MIPS') the economical part of the matter looks short-term solid (though slipping some), but the financial part (the Fed) and the political parts (tariffs, impeachment, etc.) look very shaky. Which will be in command in the next few weeks is hard to predict; but if anything goes astray on the financial or political parts, the market may drop fast and far. As far as a market "crash"? No, but very scary and potentially costly.

For help with the above, keep a constant eye on the MIPS Signals.

- BTW, all MIPS models are still Long from their 9/05/2019 signals.

Good Trading !!!

Paul Distefano, PhD

CEO / Founder

MIPS Timing Systems, LLC

281-251-MIPS(6477)

Friday, October 04 2019

It looks like the market (SPY) formed a "One Day Key Reversal" on Thursday (opened way low, closed high - see graph below):

- a Key Reversal is the point where the market trend changes direction,

- in this case, from down to up !!!

It's a good thing that MIPS remained Long (and did not get "fooled" into going Short)

Support@mipstiming.com

Paul Distefano, PhD

CEO / Founder

MIPS Timing Systems, LLC

Houston

281-251-MIPS(6477)

www.mipstiming.com

Sunday, September 29 2019

This Blog is like a continuation of the Blog that we sent out almost two months ago (see below). The reason that we are adding this new material to the previous one is to show that the current market is still waffling and nothing significant has really changed (same old, same old) in spite of what the "news" says is happening. "The press" prints what sells, truth or not. So, as you will see below, this market has been "flat" or "sideways" for almost two years now.

As you may or may not know, "sideways" markets are markets of uncertainty and/or fear (that is why they are called "consolidation patterns"). When some bad news comes out (truth or not), traders run for the hills. Then, when the bad news does not materialize, the same sellers come back buying and basically reverse their actions and fears. The main reason why most "dips" are "V-Shaped" is that the same traders that sold on the way down bought back in almost the same fashion as they sold (that is, same prices and dollar amounts).

All of the reasons from the previous email (seven of them) are still the main concerns for investors; but in reality, none may actually materialize soon. In markets like this, little guys (like us) could suffer massive losses in markets going nowhere by getting whipsawed !!!

My personal opinion is that, without any REAL massive screw-ups (as in overdone tariffs by Trump/China or stupid unnecessary rate changes by the Fed, etc) this market will break out to the upside for at least the next six months, mainly because the US economy is still strong. I can't remember a single "market crash" when corporate earinngs were high. Of course, we do not follow what I think, we follow MIPS. Stay tuned...

Here are the latest "Flat Markets" Graphs ...

3rd Quarter of 2019 (SPY)

- see the last 4 failed attempts to break the Support Level to the downside

Last Six Months (S&P 500)

- plus/minus 3.5% trading range

Long-Term View

- all the way back to 1993

- are we now in a "topping" pattern, as in 2000 and 2008 ???

Performance - MIPS/Nitro vs SP500

- Last 12 months (MIPS is blue, SPY is red)

Results are about the same (both flat), but MIPS provided a "smoother ride" (thus helping us with our health)

Please notice that when the SPY took the big dip in 4Q'18 (-20%), MIPS was up +2% (as it most likely will be on the next "big crash"). This is what MIPS members are counting on by using MIPS.!!!

Good Trading...

Paul Distefano, PhD

CEO / Founder

MIPS Timing Systems. LLC

Houston, TX

Thursday, September 12 2019

Well. today we got very close to an All-Time High with SPY (the SP 500 Index ETF).

The first graph below is a graph of the last few months with daily bars; and you can see that the SPY hit its All-Time High today, but bounced back a little (like hitting a Brick Wall).

However, the second graph with minute-by-minute bars today (9/12/19) is more telling in that it shows that the SPY hit or came very close to the All-TIme High four times, but bounced back on each and ended down.

This is a true representation of what "Resistance" means. Many believe that when a market approaches its All Times Highs from below there are millions of investors (not necessarily traders) that lived through the existing All-Time High when it happened and are very sore that they did not sell back then. Many of these swore to themselves that if or when the market hits that All-Time High again, they are going to sell. For sure, it is highly possible that there are millions more sellers than there are buyers at many All-Time High levels.

On the other hand, in up markets with strong fundamentals (high earnings, low unemployment, etc) there could be millions of buyers waiting for confirmation that the market is still an "up market". Nothing proves this more than the market breaking its All-Time High on the up side.

So, sit back and do what MIPS tells you to do (all MIPS models are Long now).

Daily Bars

Minute-by-Minute Bars

- the muted black background space on the right is "after hours"

Paul Distefano, PhD

CEO / Founder

MIPS Timing Systems, LLC

Houston, TX

281-251-MIPS(6477)

www.mipstiming.com

Monday, August 26 2019

Do you want to make money or lose money in the stock market ??

Before you start investing (NOT trading) in the stock market, you need to determine (or at least understand) how you want to invest in the market. The "high level" choices are mainly:

1) What % of your total assets are you going to invest in the market ?

2) What type of gains are you shooting for (excessive, high, moderate, low, etc) ?

3) What type of losses can you tolerate (losses are one-to-one tied to your aggressiveness in #2) ?

In the above, #1 should be easy to determine; #2 is directly tied to #3 (the more money you risk, the more you can make or lose); and #3 is where most "would-be investors" lose their shirts. Somehow, most "investors" think that they can shoot for high gains, without larger potential losses... Not true !!! The trick is to learn, and plan, how you are going to "play the game" (and some people do almost make their investing a game).

All things considered, you will do much better if you learn how to "read the market". You should learn how to do this yourself, or have quantitative analysis algorithms to help you thru the process. The worst place to get your inputs on the markets is from "the press". They simply print what they think will get them the most traffic, right or wrong.

To that end, let's look at the recent market try to ascertain if you see it the way that I do.

Short-Term Market (see attached)

In the graph below, the market (SP 500) in August has been what looks like a disaster, and is now in a very volatile sideways trading pattern between $2945/share to $2824/share (a 4.1% drop in one month). One month is sometimes important but not so much now for intermediate-term investors (like us). This is mainly because the market can go anywhere from here fast (no indication so far when/where that might be).

See attached file... May'19-Aug'19

Intermediate-Term Market (see attached)

Just like almost everything in life, stepping back for a more complete view helps us to better understand what we are looking at. In this case, see the Intermediate term view below. As you can see, the damage in August is not nearly as devastating as the press and the pros want us little guys to think we have. They want us to sell so that they can "buy on the dip".

See attached file... 2016-2019 ytd

Long-Term Market (see attached)

To see what is really going on for the long term, let's now step back even a little further (kind of like looking at a forest fire from a helicopter or airplane instead of from where we are standing). For longer-term investors (and MIPS members), it can been seen from this view that they have been in a strong up market since March'09 and should have accumulated massive gains. From that standpoint, this month's losses are basically minimal.

See attached file... 1192-2019 ytd

That said, this is still a very dangerous market. The most danger now would be in trying to trade the short-term ups-and-downs in the market (as in swing trading). This is the kind of market where "traders" get whipsawed. Remember, to prevent this MIPS rarely trades in the sideways market and either stays with the current signal (Long of Short) or goes to Cash until the coast is clear.

And remember, the press only publishes true or false news that will bring them the most traffic. Usually that results in a somewhat large short-term move in the market that recovers in the following few days/weeks.

Actual MIPS Performance (2016-2019 ytd)

Model No Leverage 1.5x Long / 0.5x Short

MIPS3 +27%.......................+41%

Nitro +35%.......................+57%

Stay tuned and let MIPS tell us what to do next ...

Paul Distefano, PhD

CEO / Founder

MIPS Timing Systems, LLC

Houston, TX

281-281-MIPS(6477)

Monday, July 08 2019

Short-Term View

Looking at the "relatively flat" market over the last 1.5 years (see graph below) and knowing about most of the economic fundamentals in the US economy (revenue growth, high corporate earnings, low unemployment, high positive sentiment, etc.), one would think that this market (which just broke out into "new high" territory), would have a long way to go up from here. And, most likely, without any major screw-ups by the Fed, the White House, Congress, China, etc., that should be the case for the rest of this year. But, that’s not all to this story. READ ON…

MIPS Performance in 2019 (thru 7/5/19)

MIPS44 (+7.5%) and MIPS/Nitro 55 (+8.3)

Long-Term View

As shown above the MIPS models have done "OK" in the short-term, with a current "sky-is-the-limit" outlook for the remainder of 2019. But the long-term outlook is another story. According to my analysis and what most indicators show me, sometime in the next 12 months we should expect a hefty market drop. This is mainly because of the "abuses" from the "big guys" like the Fed, Goldman Sachs, Morgan Stanley, major financial institutions, large banks and mutual funds, etc. (aka "fat kats"). I say the ‘big guys’ are to blame because we "little guys" do not have nearly enough money to move any of the markets or financial components.

Below are "some" of the major ramifications from these abuses that have disrupted the normal workings in many areas of the financial/economic world:

1) Trade tariffs – Very disruptive, without well thought-out consequences.

2) Corporate buy-backs – All corporate giants have spent fortunes buying back their own stocks instead of using their money to make better products, expanding their territories, sharing with their employees, etc. Of course, their object is for the company to lower its number of shares outstanding, so that even with no other improvements, their earnings/share ratio can go up even without "earning" going up at all. This makes the top management look good with no contributions/improvements coming from them. In fact, every year the execs of many large companies "earn" large bonuses for obtaining higher earnings/share ratios even though their earnings for the year were lower, but the number of outstanding shares (after buy-backs) were even "more lower". The fat-kats are the big winners from buy-backs in the long term.

3) Interest Rates – Out of desperation, the Fed in the US and the European Committee overseas, have kept interest rates very low in order to protect their jobs. It seems that they are almost always out-of-sync with their countries’ economics. In fact, in some countries the interest rates are "negative" meaning that bond buyers pay the bond owners (the lenders) some annual % to own their bonds instead of getting annual yields for themselves, as per the norm.

4) Inverted Bond Yields – At this time, we are experiencing a situation that rarely occurs, but when it does happen, over 80% of the time a "recession" comes within the next 12 months. This is when the yield on 10-year Gov’t bonds drop below the yield on 3-month Gov’t bonds ("Inverted"). This means that investors are comfortable with short-term bonds but NOT with long-term bonds (not comfortable with the future).

5) Country Debt vs Gross Domestic Product (GDP) - Because of mismanagement in many countries throughout the world (even in Europe), their countries’ debt is several times greater than their GDP. In some, their debt is over 3 times higher than their annual production. That sure makes it tough, if not impossible, for them to pay back their national debt. This will ultimately lead to these countries either going bankrupt or having to devalue their currency, either of which could lead to a worldwide financial meltdown. Sadly, even in the USA today, our country’s debt is over 75% of our GDP.

6) Margin Debt – Driven by greed, investors will buy (or short) stocks "on margin" (i.e., with borrowed money). Too much margin debt can be very dangerous, as in the Crash of 1929 (when margin debt was extremely high). Margin is dangerous because, with 2x margin, if what you buy drops 40%, you would lose 80% of your original investment. At this time, margin debt in the USA is near its all-time high in the last 50+ years.

7) Shift from Stocks to Bonds - In the last 2 years, there has been a major shift by the fat kats in the money they are investing in bonds that is coming from their stock holdings. That is a bad sign for the stock market in the near future because when the big guys bail out on high volume at the top, they ‘cause’ market tops (just like their high volume buying near the bottom "causes" market bottoms).

The above could surely result in a market correction or crash in the next 12 months.

Stay tuned in and let MIPS guide you like it did in 2008 !!!

Good Trading…

Paul Distefano, PhD

CEO / Founder

MIPS Timing Systems, LLC

Houston, TX

www.mipstiming.com

281-251-MIPS(6477)

|