With the recent price action in the stock market, one may ask if we are in a "New Bull Run" or a "Bear Market Rally" ?

If we look at the S&P 500 Index (or the SPY) over the last 12 months, this market does not look like it is going anywhere, except maybe up and down over-and-over again. Or, maybe even down, if not for the recent rally. The question is, "is this recent rally for real" or just a natural kick-back from a big drop (bear market rally)?

But, as active investors, we do not have the luxury to sit back and "only" analyze the market activity over the last year. We need to know where this market is going from here, now !!!

Read on...

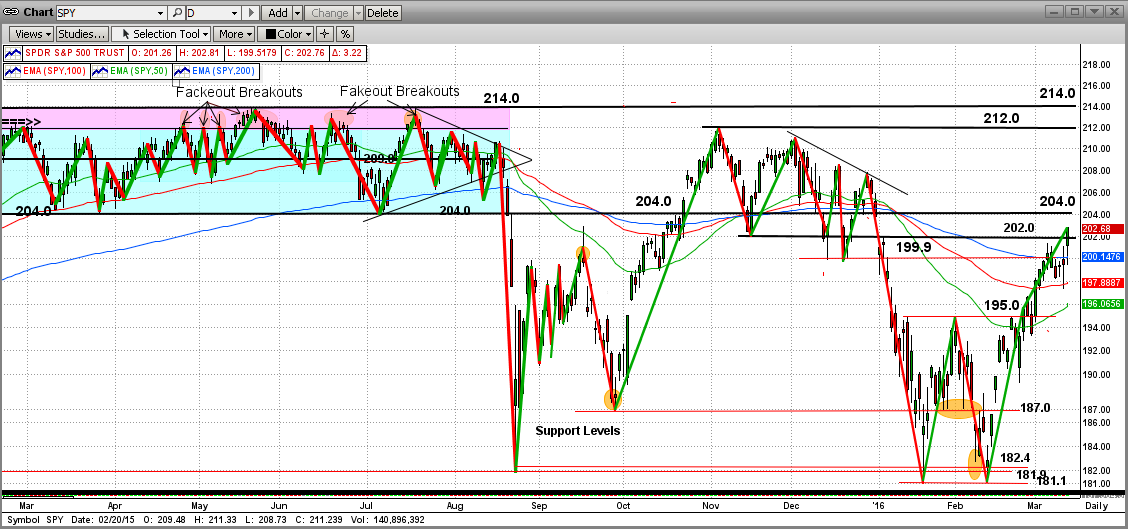

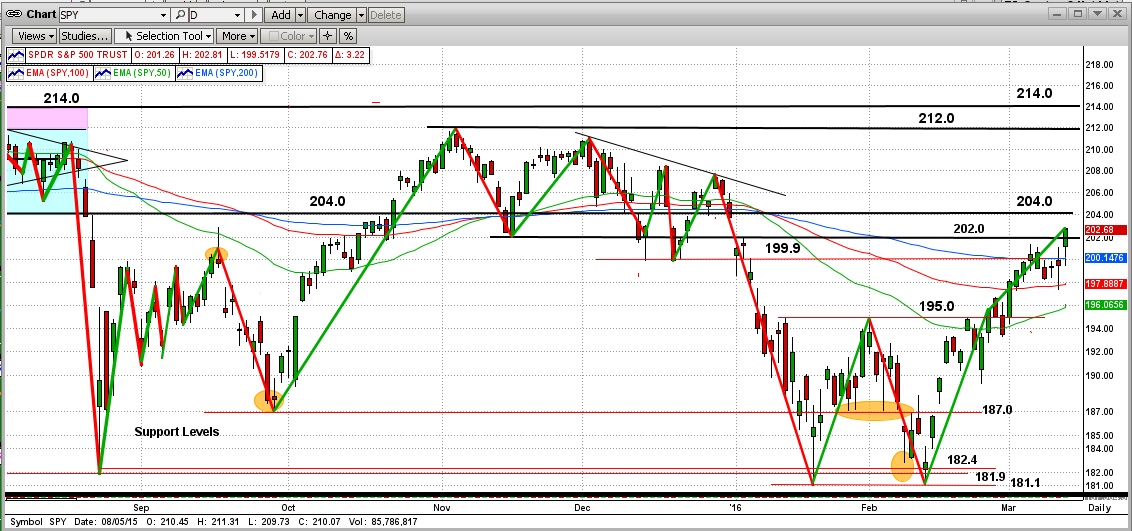

In the graph below, you can see that after several drops and kick-backs, the SPY hit and bounced off of its strong support at the SPY level of 181.0 (SP500 1810) in mid-February of 2016.

Even though there were a few other hurdles along the way up, we (and everyone else on the planet) knew that the SPY would face its toughest upside resistance at the top of the double bottom pattern at 195.0 (SP500 1950). Needless to say now, the SPY broke through 195.0 with force at the beginning of Mar'16. That was really bullish !!!

So, where does this leave us? Since its breakout at 195.0 (SP500 1950), the SPY has managed to break through 202.0 and head for the nasty tight-trading "channel" where it "lived" for all of the first 8 months of 2015. This "channel" is between SPY 204.0 and 214.0 (SP500 2040-2140). If the SP500 actually hits 2140 (SPY 214.0), it will be at an all-time high, and then the sky is the limit.

But, since there are no guarantees, this market could easily fail in its attempt to reach a new all-time high, and head back down and turn into a real "market crash". Please understand that "this risk is not gone". We will leave that analysis up to MIPS. Stay tuned...