Press ? for keyboard shortcuts.

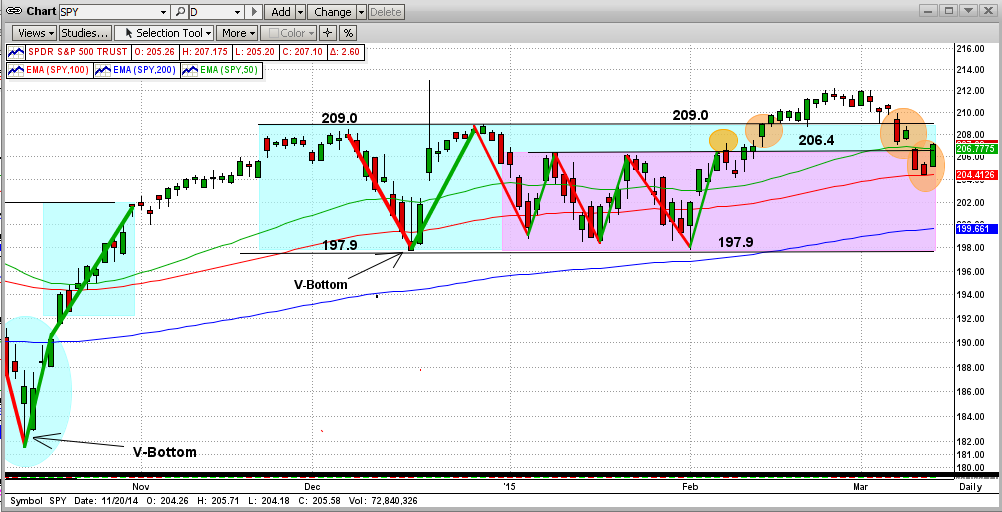

The only good news that I could muster out of the last 2-3 weeks of "market noise" was that:

1) the Fed is still "dovish" with regard to raising interest rates,

2) the Fed still "rules",

3) relatively low volume says that it was not the Fat Kats causing last week's minor sell-off,

4) the SPY closed up above its 100-day EMA in the last two "attacks", and

5) this sideways trading pattern is getting "long in the tooth".

From this, one could expect a market bounce-back going forward, if not an SPY run-up to above $209. But, of course, it's anybody's guess from here, so let's simply follow MIPS' advice. Stay tuned !!!

BTW, these "sideways trading patterns" do not last forever. Many times, they break out in the same direction that they went in (up, in this case). And, the longer the time in a sideways pattern, the bigger the market move after the breakout.

ress ? for keyboard shortcuts.

In mid-February, the market (the SPY) broke out of its sideways trading pattern ("No-Man's-Land") and headed to what one might have thought was a new uptrend. As always, however, the market had its own view on what it was going to do, and it does as it wants. As we all know, starting on March 1st, the market stalled and waffled for a few days.

Then, the SPY got slapped back into No-Man's-Land, with a big drop on 3/06/2015. Ironically, the catalyst for this big drop was "too good" economic news, after a surprisingly good new jobs report and shrinking unemployment. Of course, good economic news should be good for the market, and it ultimately will be. But, this was mitigated away by "fear" of the Fed raising interest rates in June or September, which "overcame" the good economic news because it "MIGHT" affect the Fed's actions months from now. From my experience, these "knee-jerk" reactions to what might happen bad in the future that could trump positive results that have already happened, usually fizzles out within a few days. And this is exactly what happened today (3/12/15). I must add that today's positive move was also aided by the "cooling off" of recent gains in the value in the dollar.

In the graph below (right-most orange circle), you will see that the SPY "held its ground" and bounced off of its 200-day EMA at $204.4 on 3/11/15; and then it climbed all the way back above its 50-day EMA to close at $207.1 today (3/12/15). I personally believe the market will go up from here, at least to again test the upside resistance at $209 on the SPY. What happens after that is anybody's guess, but MIPS will be watching closely for us. Stay tuned...