Sunday, October 22 2017

Recently it seems that the major concern from almost all investors in the stock market is: “How much longer will this market continue to run up?” That is a very legitimate question, and it has a very simple answer (which, of course, is unusual in stock market behavior). More later …

BUT FIRST …

The recent Bull Run (since election in Nov’16) in this very strong Bull Market (since 2009) has been very consistent, and with very low volatility.

Some of the characteristics of this strong Bull Run are:

- Using data all the way back to 1928, this Bull Run has just tied an 11-month “streak” from the 1990’s where the market did not experience a “correction” worse than -3%.

- This is the first time in 20 years that the DOW was up for 8 quarters in a row.

- The Dow and SP500 experienced 9 monthly gains in a row, with both reaching multiple new highs in September.

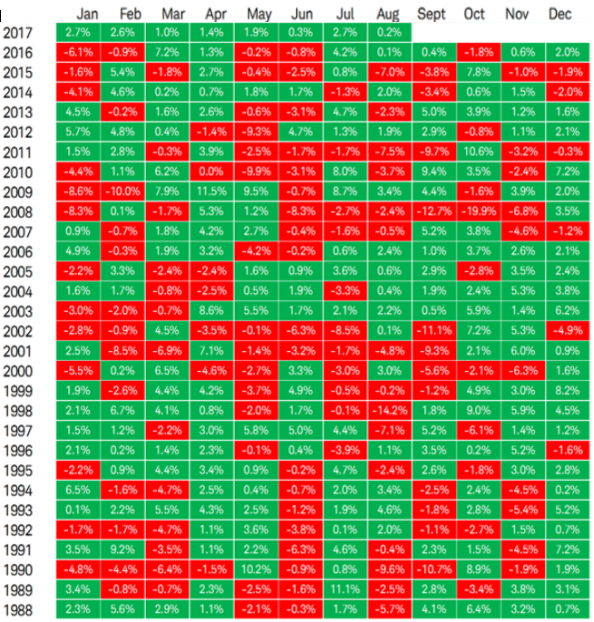

Going forward, some interesting historical statistics from Market Watch (4th Quarter Reputation) are:

1) Historically the 4th quarter is the strongest quarter of the year.

2) Since 1950, the 4th quarter has been up 80% of the time, with an average growth

of nearly 4%.

3) September is usually the worst month the year, but not this year.

4) In 11 of the last 12 years, when the S&P 500 was up more than 10% through the

3rd quarter and it made a new high in September, the average 4th quarter returns

have been +5.9%.

WHAT IS DRIVING THIS MARKET?

Like almost all other times in the market, the ultimate driver of stock prices is CORPORATE EARNINGS. The market is certainly somewhat influenced by other things (like, inflation, interest rates, global instability, etc.), but these are not consistent predictors of future market direction. For example, over the last 20+ years, the market has moved both with and against inflation. So, when following anything other than earnings, usually the effect is temporary (like BREXIT) or way off in time.

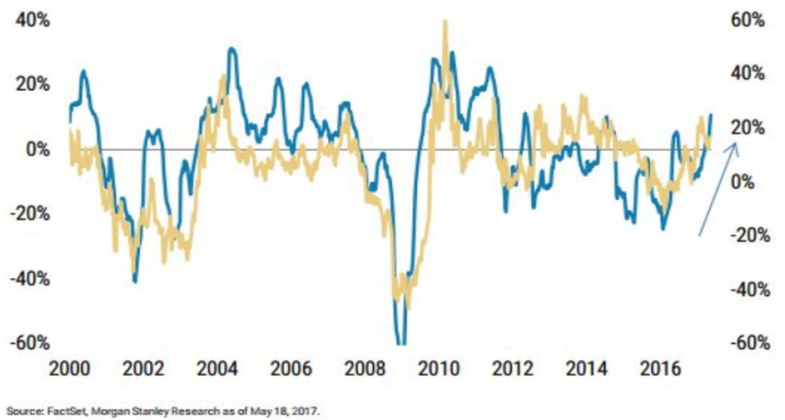

From Morgan Stanley

Blue Line (Left Scale) = Earnings

Gold Line (Right Scale) = Stock Gains/Losses

As can be seen above, stock prices ultimately follow corporate earnings. But in many cases, stock prices move first, in anticipation of earnings growth. The recent behavior in the market is a good example of this. Investors began pushing stock prices up immediately after the presidential election in anticipation of Trump’s economic agenda (fewer regulations, lower corporate taxes, better international tariffs, etc.) leading to more jobs and higher earnings. Since then, economic conditions have improved nicely and stock prices continue to rise.

So, why are so many investors so skeptical? Mainly because they feel that the stock market is greatly “oversold”, because stock prices are way too high as measured by the Price/Earnings (P/E) ratios of the major Indices. For example, the P/E ratio for the S&P 500 Index is now over 25, when the long-term average is closer to 15. That is indeed high and could lead to bad future returns; but it does not necessarily have to.

Many investors mistakenly interpret the above as a condition when prices must drop in order to bring the P/E ratio back down closer to past averages. BUT, what most of them seem to miss (or discount) is that the P/E ratio of an Index (like the S&P 500) also comes down when Earnings rise, even if stock Prices remain about the same. [Remember, the value of a “ratio” like A/B comes down when the denominator “B” goes up if the numerator “A” stays the same.] And, the “E” (earnings) in the PE ratio is now on the rise at a high pace and this should continue, given lower corporate taxes and more attractive international tariffs for US companies.

WARNING:

Please be aware that, if the economic progress in our country gets derailed (failed tax cuts, lower job creation, lower corporate earnings, North Korea, etc), the current Bull Run could (and most likely would) quickly “stop running” and it may even turn into a classic market crash.

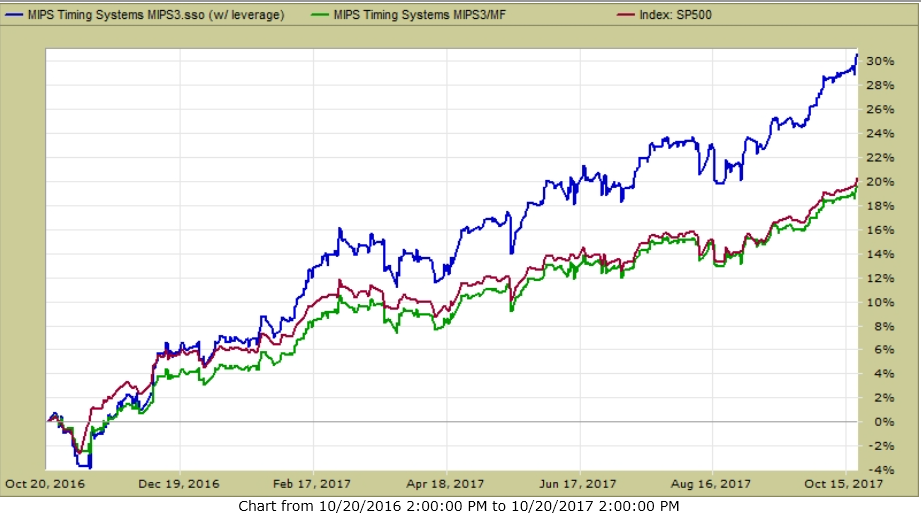

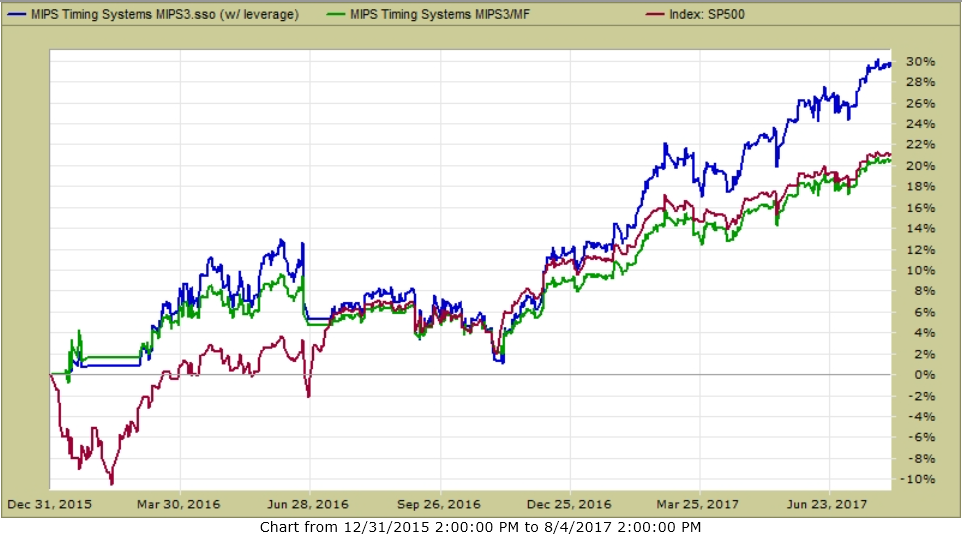

So, how have the MIPS models performed in the last 12 months?

RECENT Performance of the MIPS3 model:

- 12 months ending 10/20/2017

- with and without leverage *

MIPS3 (last 12 months)

- Trading SPY Long / SH Short

Green Line 1.5 x Long / 0.5x Short +31%*

Blue Line 1.0x Long / 1.0x Short +20%

Red Line - SPY Buy/Hold +21%

Best Wishes…

Paul Distefano, PhD

MIPS Timing Systems, LLC

Houston, TX

281-251-MIPS(6477)

Monday, October 02 2017

Can anyone develop a "perfect timing model"? Not at this time, but with advances in quantitative modeling (applied mathematics, artificial intelligence, pattern recognition, big data, etc.), the accuracy of quantitative modeling is improving amazingly fast. In 10-15 years, computer trading will be dominant.

In fact, outside of the investment community, the rest of the world has had "near perfect" models in use for many years now. Some examples are: (a) auto-pilot in commercial aircraft, (b) auto-control of nuclear power plants, (c) rockets that send men to the moon and back safely, and (d) fighter jet software (F-15 and F-35) that seeks, finds, tracks, and shoots down enemy aircraft amazingly fast.

Immediately below, let's look at an illustration of a "Perfect Timing Model" beating buy-and-hold in the stock market. After that, we can see how a real timing model actually worked in 2007-2017, as verified by TimerTrac.com. Then, you can determine for yourself if a model like this is "near-perfect enough" for you, or if you think that you can do better yourself.

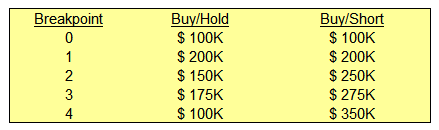

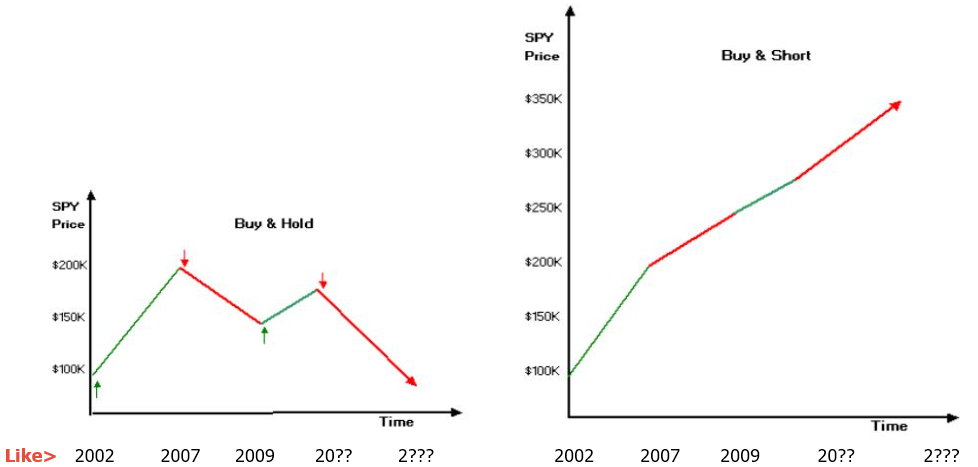

PERFECT TIMING MODEL

Every investor (large and small) wants to make money in both up and down markets, but they don't know how. Indeed, this is difficult but not impossible. The illustration below shows the hypothetical performance with both a Buy-and-Hold Strategy and a Perfect Timing Model (Buy/Short). Even though a perfect Timing Model does not exist, some models on the market today (like MIPS) come close as they soundly beat Buy/Hold over time.

Let's suppose the market performs as in the table immediately below for 4 "Legs" of ups and downs:

I.) The middle column in the table and the graph below on the left show the performance of Buy/Hold.

II.) The rightmost column in the table and the graph on the right represent the performance of a

Perfect Timing Model.

A REAL TIMING MODEL (near perfect?)

The section shows the actual MIPS3/MF.org performance in a market moving something like that of the first 3 "Legs" depicted above, by using actual data from the period of 2007-2017 ytd (verified by TimerTrac.com). Why just 3 Legs? Because, since 2009. the market is still on the 3rd Leg. The next big drop will be like the 4th Leg above, and it is definitely coming.

If you asked hundreds of investors questions about investing in the stock market, you would get diverse answers to each question. There is one question, however, that they would all answer with a resounding "YES". That question is: "Would you have a lot more money today had you not lost 35-60% of your portfolio value in the market crashes in 2000 and 2008?"

That is why the primary objective for a stock market timing model should be to beat the major indices (like the S&P 500 ETF "SPY") in UP and DOWN markets. But, in real life, it would be more realistic to say that the objective should be to keep up with or beat the SPY in up markets, and either go to cash or soundly beat the SPY in down markets. It's sad to say that only a very few timing models meet that objective on a long-term basis. Most do well in up markets but not so well in down markets, or vice versa.

To this end, below you will find results from TimerTrac.com for our MIPS3/MF.org model between 2007 and 2017 ytd. For this, we traded with a popular investing strategy, namely 1.5x SPY Long and 0.5x SH Short (0.5x SH Short for lower risk).

|

Time Frame

|

SPY Buy/Hold

|

MIPS3.org

1.5x / 0.5x

|

| 2006 - 2007 |

+15.5% |

+20.5% |

| 2008 |

-38.5% |

+22.0% |

| 2009 - 2017 |

+170.0% |

+370.0% |

GRAPHS

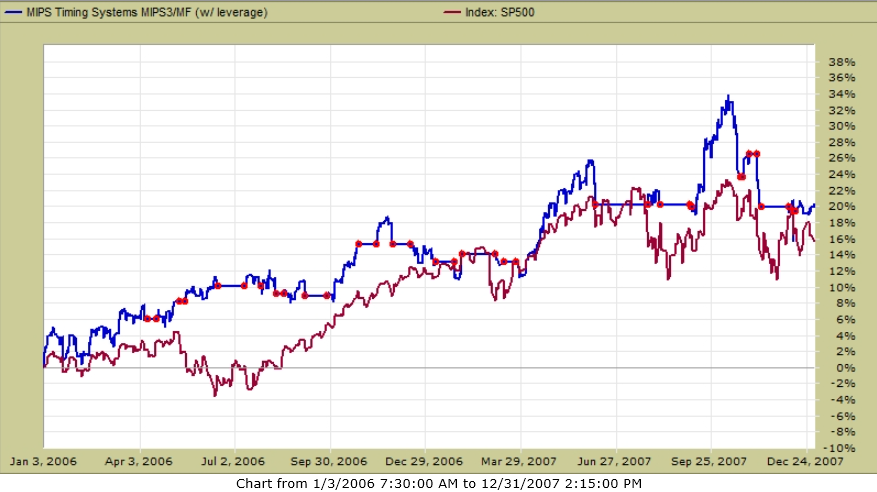

The vertical "scales" on the graphs below are different from each other

(scales optimised to show the complete graph in the same space)

I.) MIPS3/MF.org

Trading 1.5x SPY / 0.5x SH

2006-2007 <==

Up Market

MIPS 1.5x Long /0.5x Short +20.5%

SPY Buy-and-Hold +15.5%

* Red dots designate trade dates

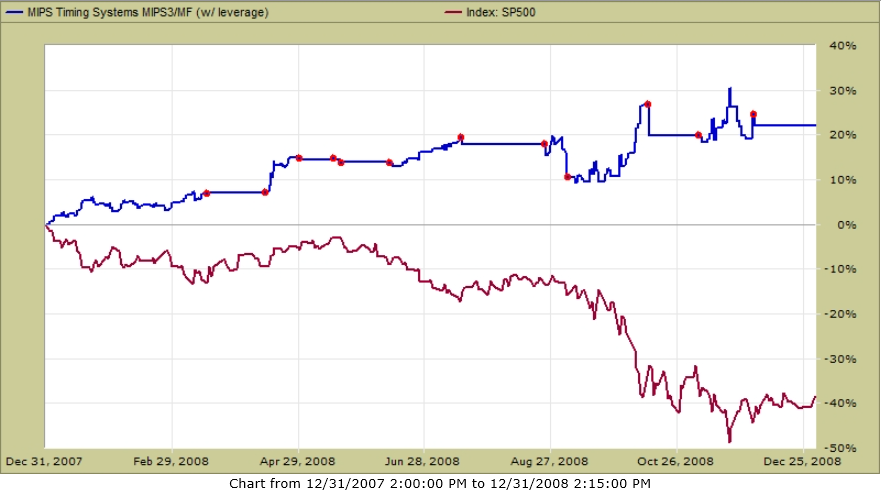

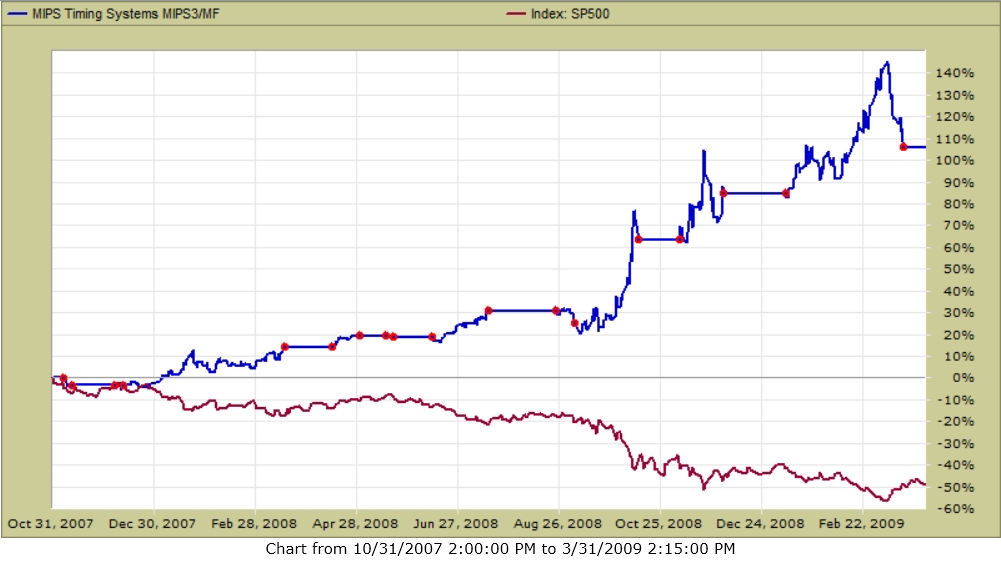

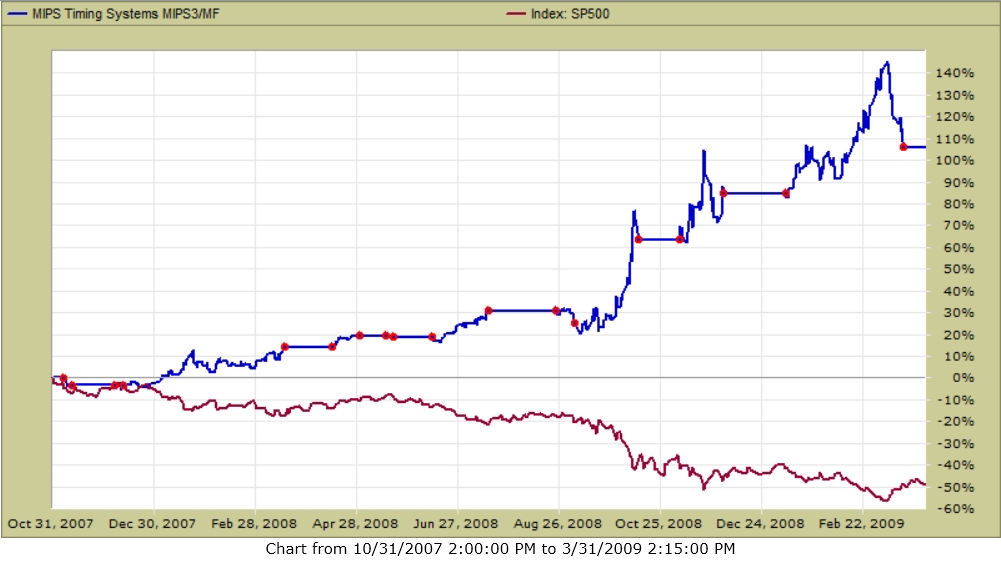

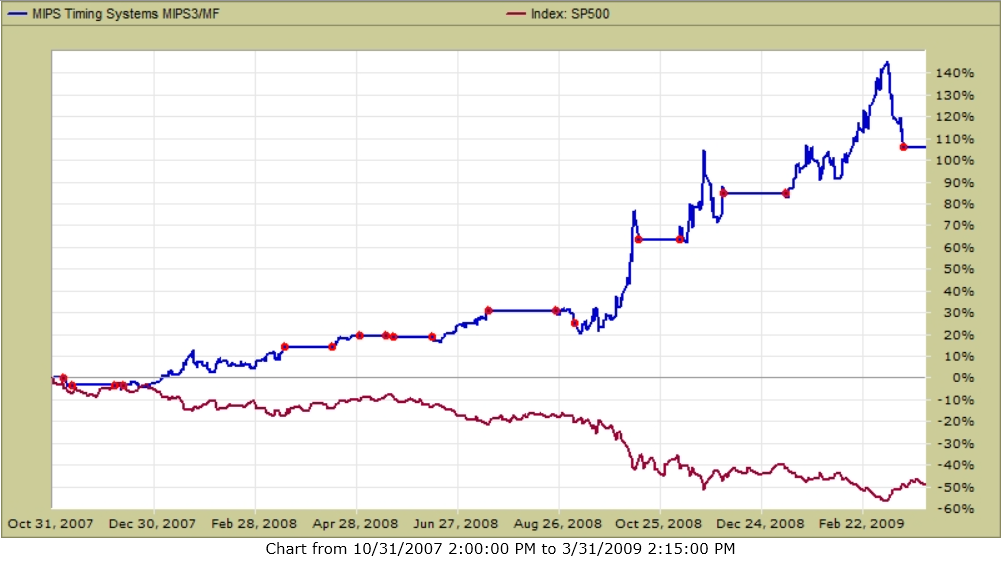

II.) MIPS3/MF.org

Trading 1.5x SPY / 0.5x SH

2008 <==

Down Market

MIPS 1.5x Long /0.5x Short +22.0%

SPY Buy-and-Hold - 38.5%

* Red dots designate trade dates

III.) MIPS3/MF.org

Trading 1.5x SPY / 0.5x SH

2009-2017 ytd <==

Up Market

MIPS 1.5x Long /0.5x Short +370%

SPY Buy-and-Hold +170%

* Red dots designate trade dates

Monday, September 25 2017

Evaluating Timing Models !!!

Stock market timing models are difficult to evaluate, but you do not have to completely understand the interworking of the models.

For any model you are considering investing with, you should at least know:

- What is the background of the model developer ?

- that is, is he/she qualified to develop a sophisticated timing model ?

- On average, how many times does the model trade every year ?

- some models issue about 12 trades/year and others over 100 times/year.

- Are the long-term performance results of the model outstanding ?

- for example, does the model beat buy-and-hold in both up and down markets ?

- to satisfy the above, your evaluation must include at least one market crash (as in 2008).

- Are the performance results Verified by a 3rd-party tracking company ? ***

- like, TimerTrac.com, ThetaResearch.com, etc.

*** Non-Verified Performance

If the hypothetical backtested (non-verified) performance of a model:

- comes from a company's first model, do not trust the results;

- comes from a company that has several older verified models that produced lousy performance results, do not trust the newer results;

- comes from a company that has several older verified models that produced very good performance, you can trust the results from the new models (because they usually retain 85-90% of the code/signals from the older models, together with 10-15% of new code that contains algorithms which produce a higher percentage of winning trades).

If the information that you have available for any model is not enough

to satisfy the conditions above, you should NOT use that model.

On the other hand, it you can evaluate a model as above,

you most likely do not need any other info !!!

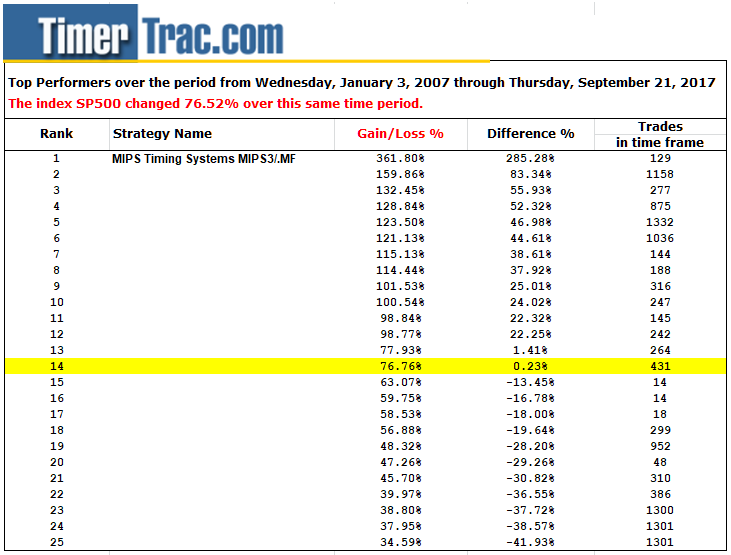

Friday, September 22 2017

ABSOLUTELY NOT !!!

The table below shows the ranking of the top 25 models that TimerTrac.com tracked in the period of

2007 - 2017 ytd. MIPS3/MF is the #1 Ranked model out of the top 25.

Please note that the performance of these models is NOT correlated to the number of trades they issued.

For Example:

MIPS traded about 130 times in this 10-year period and was the #1 Ranked model with a gain of 362%, whereas the #25 Ranked model traded 1,300 times and was only up 35% !!!

Saturday, September 16 2017

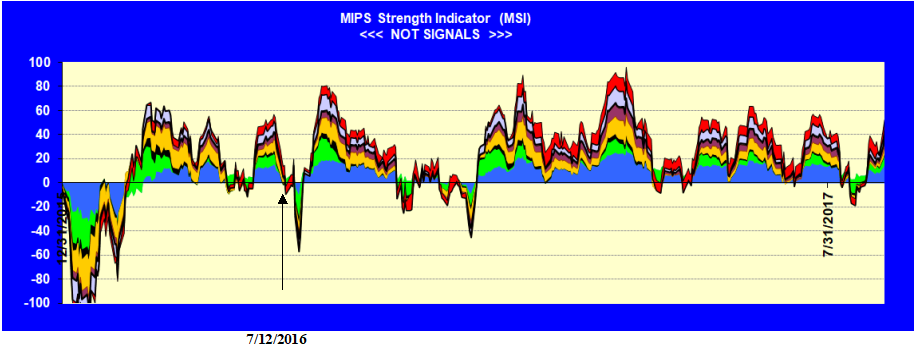

We all know that the current up-trend in the SPY has been strong since Mar'16. There might be a slight degree of degradation at this time, but not much.

Of course, MIPS remains relatively positive

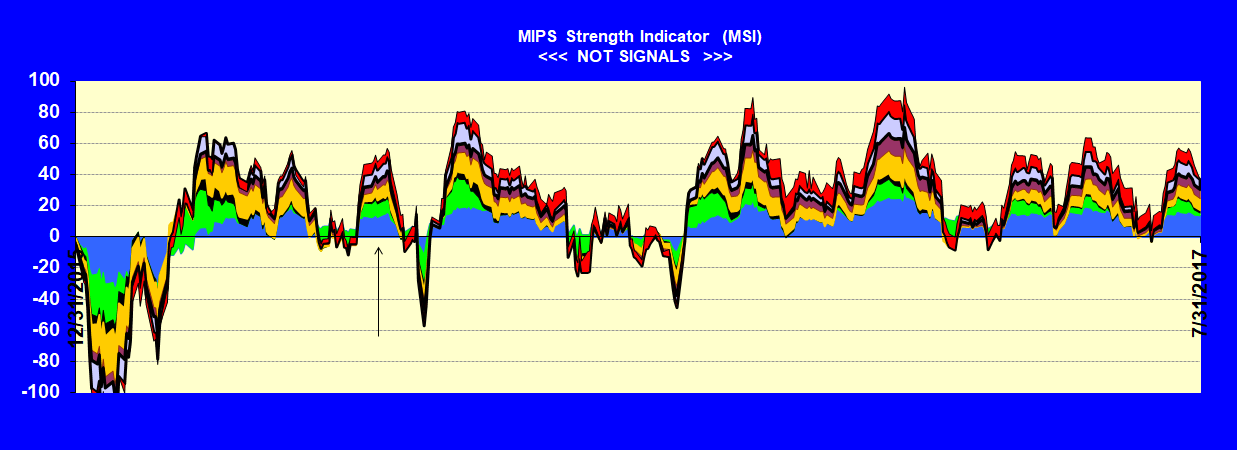

- see the MIPS Strength Indicator (MSI) immediately below.

- this is a combo of some of the best MIPS technical indicators and math algorithms.

- the black arrow from the bottom on 7/12/2017 identifies the last trade for some of the MIPS models.

Here is what today's trend looks like from a technical perspective.

Note: Almost perfect, low volatility "Up -Trending' EMAs (50-100-150-200-Day EMAs)

Monday, September 11 2017

FYI - Stocks have not been rallying for the last 10-16 months in the USA alone.

The current trend in the S&P 500 has been up for a relatively long time. But it is not alone. The MSCI All-Cap World Index (ACWI) has been up EVERY MONTH for the last ten months (and for 13 of the last 14 months). This is the first time in its 30-year history that a rally in this Index has been this perfect for so long. See the Table immediately below.

We all know that the current trend in the SPY has been strong since 3Q'16, and continues to be at this time. When a potential war with N. Korea, multiple record-breaking destructive hurricanes, a severely divided country and Congress, etc., is not enough to "turn a trend", then almost by definition, that trend must be strong.

Here is what today's trend looks like from a technical perspective.

Note: Almost perfect, low volatility "Up -Trending" EMAs (50-100-150-200-Day EMAs)

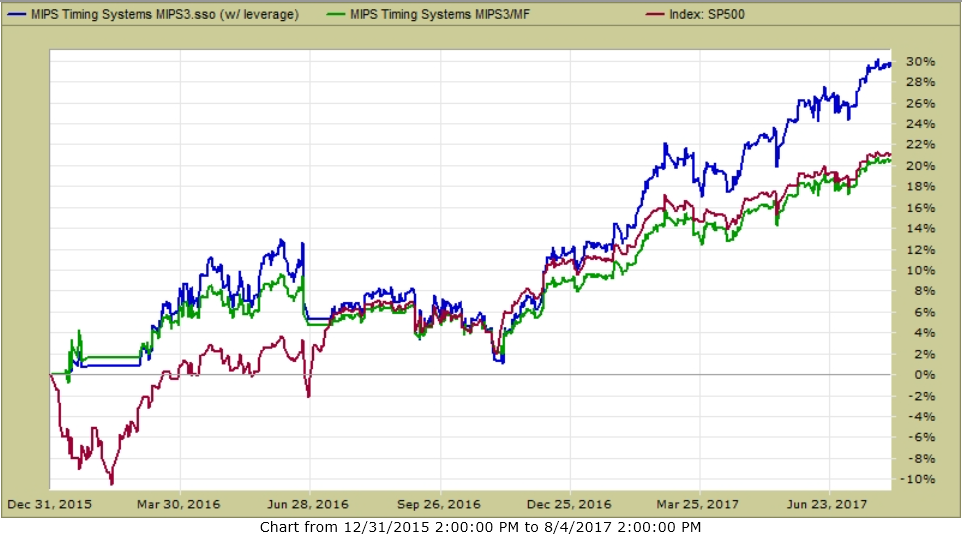

So, how has MIPS performed in the time period?

MIPS is doing a great job of not getting "sucked in" to the little dips over the last 18 months and has produced excellent results.

2016 - 170908

Blue Line - MIPS3 1.5x Long / 0.5x Short +29.5%

Green Line - MIPS3 1.0 Long / 1.0x Short +20.5%

Red Line - SPY + 2.5%

(From Timer-Trac.com)

Paul Distefano, PhD

MIPS Timing Systems, LLC

Houston, TX

281-251-MIPS(6477)

Sunday, August 20 2017

Some "Traders" (mainly day-traders) are panicking because the market (the SPY) has fallen 2.2% in the last few days, and they should be. "Investors", like us at MIPS however, should not be shook by a 2.2% drop following a 18.9% gain on the current signal.

BTW, the MIPS models have some degree of relativity built-in so that, under some conditions, the models will consider a 2.2% drop on a 18.9% gain worthy to analyze closely, but not enough to run for the hills. On the other hand, had the 2.2% drop occurred after only after like a 4.1% gain, the MIPS models would most likely have gone short by now.

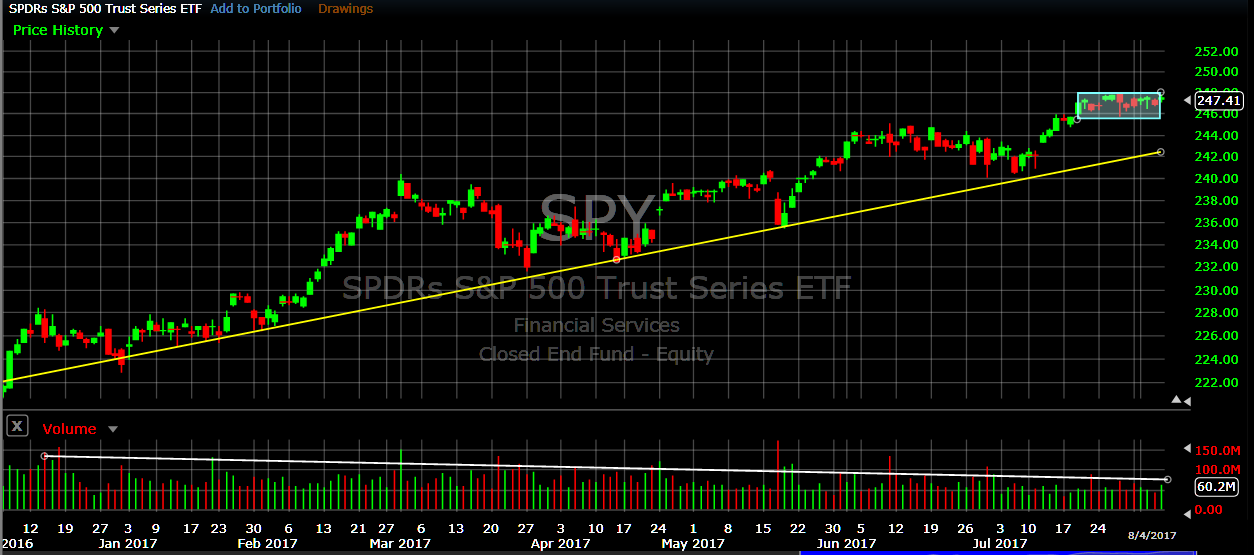

See the chart below:

1) The MIPS4 model has been long since 7/12/17 and had gained 18.9% by 8/08/17; only to

lose back 2.2% of this gain by 8/18/17 (net YTD gain of approximately +16.7%).

2) The SPY broke its trend line slightly by 8/18/17; but closed above its 90-day EMA (red line).

We all know that the market can move in any direction from here, so look out for Signal Change emails from MIPS, and check the "Current Signals" at http://www.mipstiming.com/signals_results

Paul Distefano, PhD

MIPS Timing Systems, LLC

Houston, TX

281-251-MIPS(6477)

Monday, August 14 2017

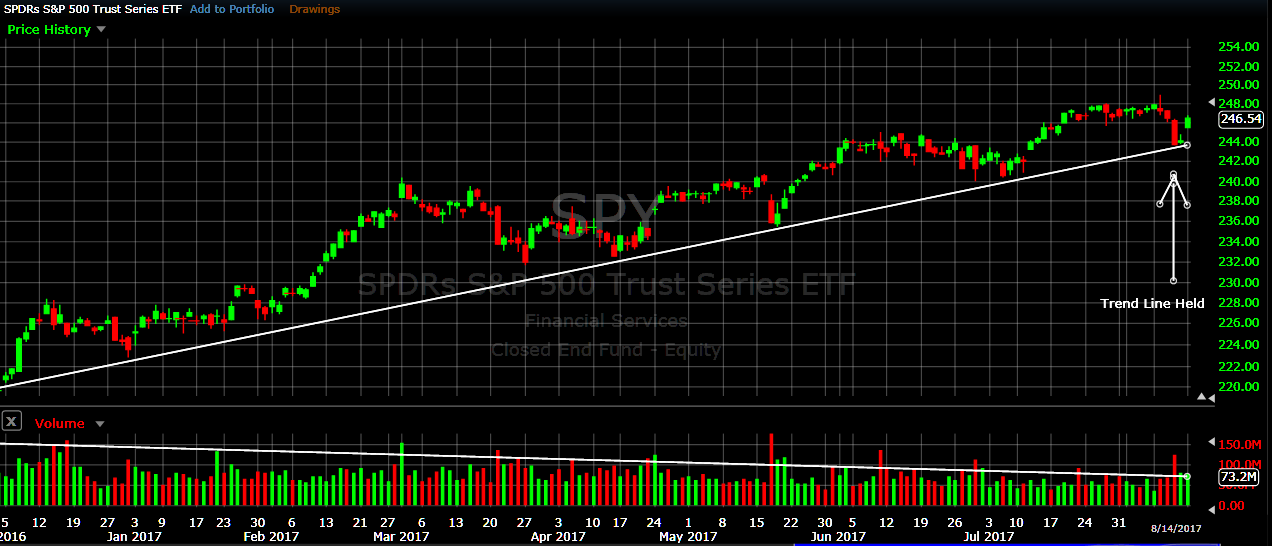

Remember, "The trend is your friend" !!!

The market (S&P500 ETF SPY), held its trendline last week and bounced off its trend to the upside today.

- holding above the trend is very bullish, but

- ever decreasing volume is slightly bearish.

Don't fight the Trend...

- MIPS Members can see what MIPS did at http://www.mipstiming.com/current_signals

Paul Distefano, PhD

MIPS Timing Systems, LLC

Houston, TX

281-251-MIPS(6477)

=============================================================

<<< Blog from 8/06/2017 >>>

MIPS Members:

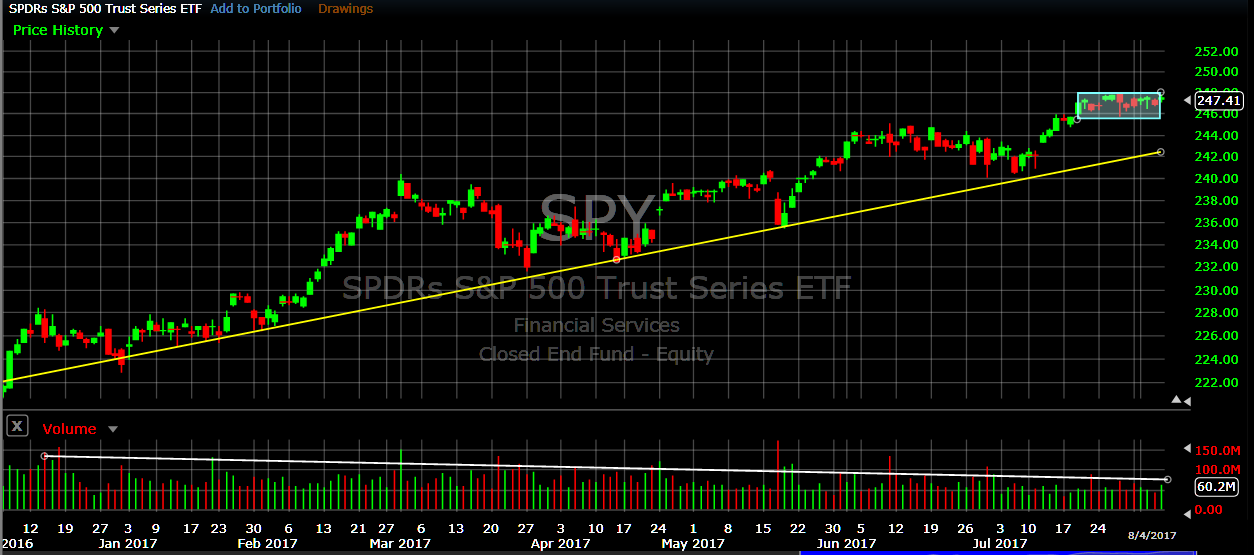

The long-term market trend is UP, and in up markets almost every investor has been told "don't fight the trend". But, of course, all trends come to an end, and that is what leads to market cycles and even market crashes. This upside trend has lasted for well over a year, with historically low volatility, and may be ready for at least a correction. See the graph below for the market (SPY) movements over the last 9 months.

It can be seen above that the market has followed a near-perfect uptrend, with higher highs and higher lows. However, the daily volume in this time period has dropped nearly 40%, and this is not a good sign from the Big Guys.

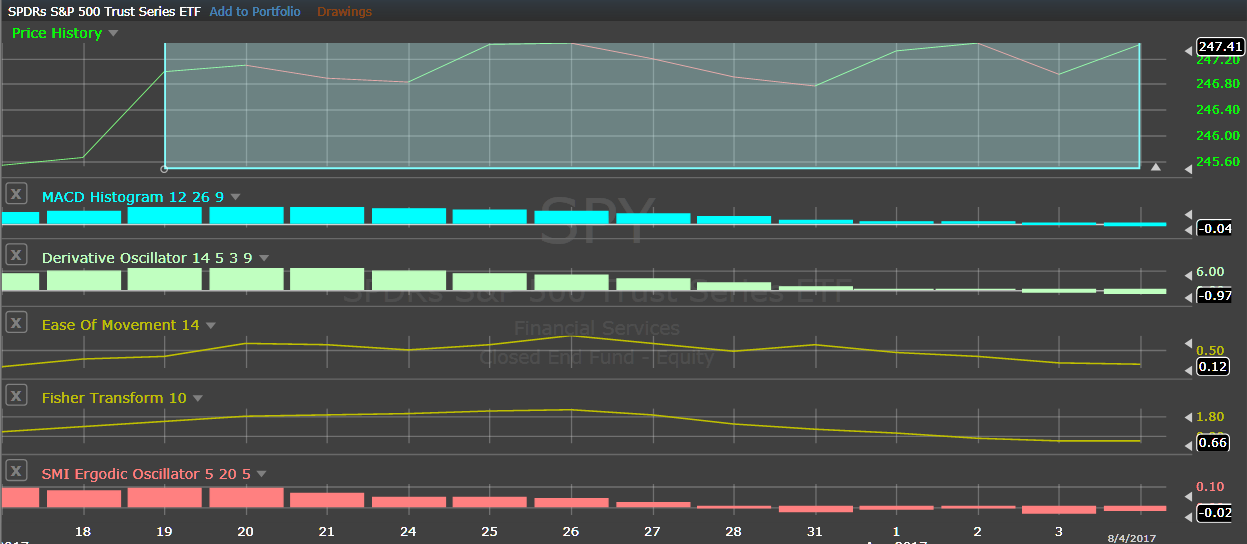

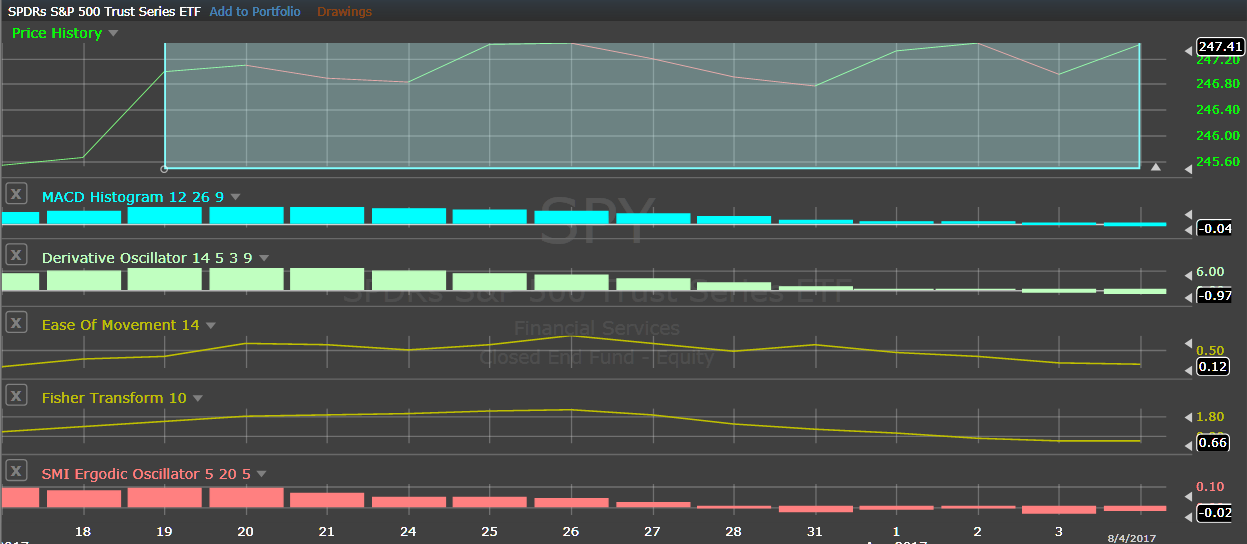

MIPS xRay View

And, in the last couple of weeks, the market seems to be flattening-out. For this, let's "zoom-in" and go into our xRay view to see an example of what's going on under the skin in a certain part of the MIPS models (see graph immediately below).

When we take the volatility out of the price action of the SPY over the last two weeks as done above, we see that the market closes have indeed been VERY flat. From this, one might expect that the indicators in the MIPS models are also flat (like not moving up or down). In actuality, you can see that ALL of the five indicators above are decaying from positive to negative (or close to zero). This could indicate that the uptrend is decaying. Of course, this is a VERY small part of a MIPS model (5 out of over 150 indicators and lots of math), and other parts of the models are signaling that the market still has steam. For example, see the MIPS Market Strength Indicator (MSI) below.

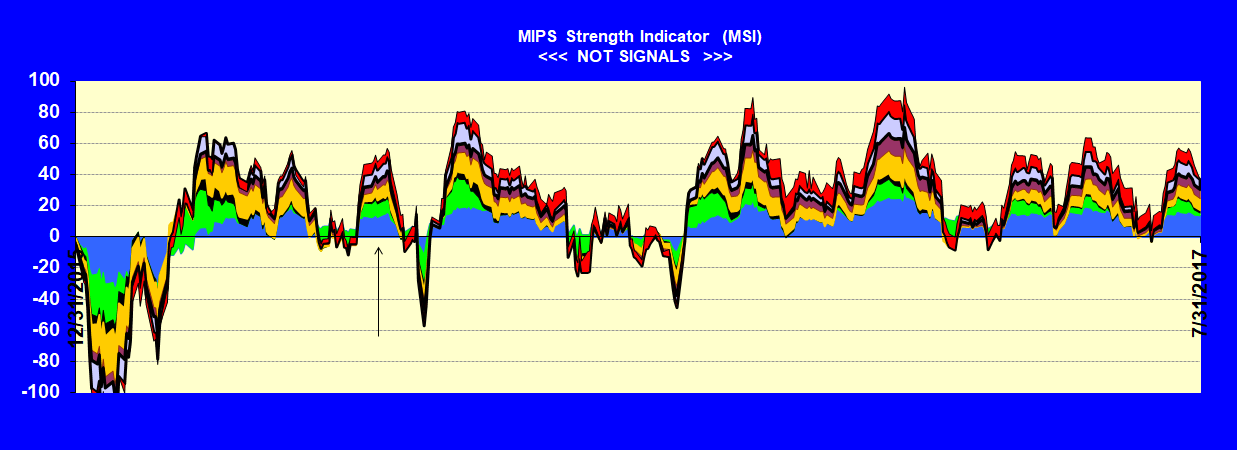

MIPS Market Strength Indicator (MSI)

The MSI graph below shows the relative strength of 8 of our best indicators. These are showing a neutral to positive view of the market direction at this time, and never went seriously negative since early 2016.

.

MIPS3 Performance 2016-2017 YTD

All of the MIPS models are still Long, and the performance since 2016 has been very good.

Of course, we will continue with the Long signal from MIPS until MIPS changes its mind.

MIPS3 - 2016 - 08/04/2017

(Trading SPY Long / Short)

Blue Line 1.5x Long / 0.5x Short +30.0%

Green Line 1.0 x Long / 1.0x Short +20.5%

MIPS3 in 2008

And, don't forget how MIPS3 did between Oct'07 and Mar'09 (see graph below).

SPY -50% MIPS3 +108%

CONCLUSION:

MIPS's position is that the market still has an upward bias, and we expect more growth from this market. But, MIPS is seeing some aspects of a neutral or decaying trend. From the above, you can see that MIPS is doing whatever it needs do to to ascertain when the market is going south, and then getting us out. This is the time when you make big bucks using good timing models, like MIPS3 and MIPS4.

Stay tuned...

Best Wishes !!!

Paul Distefano, PhD

MIPS Timing Systems, LLC

Houston, TX

281-251-MIPS(6477)

Sunday, August 06 2017

The long-term market trend is UP, and in up markets almost every investor has been told "don't fight the trend". But, of course, all trends come to an end, and that is what leads to market cycles and even market crashes. This upside trend has lasted for well over a year, with historically low volatility, and may be ready for at least a correction. See the graph below for the market (SPY) movements over the last 9 months.

It can be seen above that the market has followed a near-perfect uptrend, with higher highs and higher lows. However, the daily volume in this time period has dropped nearly 40%, and this is not a good sign from the Big Guys.

MIPS xRay View

And, in the last couple of weeks, the market seems to be flattening-out. For this, let's "zoom-in" and go into our xRay view to see an example of what's going on under the skin in a certain part of the MIPS models (see graph immediately below).

When we take the volatility out of the price action of the SPY over the last two weeks as done above, we see that the market closes have indeed been VERY flat. From this, one might expect that the indicators in the MIPS models are also flat (like not moving up or down). In actuality, you can see that ALL of the five indicators above are decaying from positive to negative (or close to zero). This could indicate that the uptrend is decaying. Of course, this is a VERY small part of a MIPS model (5 out of over 150 indicators and lots of math), and other parts of the models are signaling that the market still has steam. For example, see the MIPS Market Strength Indicator (MSI) below.

MIPS Market Strength Indicator (MSI)

The MSI graph below shows the relative strength of 8 of our best indicators. These are showing a neutral to positive view of the market direction at this time, and never went seriously negative since early 2016.

.

MIPS3 Performance 2016-2017 YTD

All of the MIPS models are still Long, and the performance since 2016 has been very good.

Of course, we will continue with the Long signal from MIPS until MIPS changes its mind.

MIPS3 - 2016 - 08/04/2017

(Trading SPY Long / Short)

Blue Line 1.5x Long / 0.5x Short +30.0%

Green Line 1.0 x Long / 1.0x Short +20.5%

MIPS3 in 2008

And, don't forget how MIPS3 did between Oct'07 and Mar'09 (see graph below).

SPY -50% MIPS3 +108%

CONCLUSION:

MIPS's position is that the market still has an upward bias, and we expect more growth from this market. But, MIPS is seeing some aspects of a neutral or decaying trend. From the above, you can see that MIPS is doing whatever it needs do to to ascertain when the market is going south, and then getting us out. This is the time when you make big bucks using good timing models, like MIPS3 and MIPS4.

Stay tuned...

Best Wishes !!!

Paul Distefano, PhD

MIPS Timing Systems, LLC

Houston, TX

281-251-MIPS(6477)

Monday, July 17 2017

Nothing moves the stock market in a more predictable fashion than corporate earnings. At this time, investors are betting on the Trump agenda (lower taxes, better intenational trade deals, less giveaways, less regulations, etc.) to greatly increase corporate profits. Hence, the big run-up in the markets since the presidential election in Nov'16.

Although there are many obstacles along the way, the bet is still that most of the above will become "law", and this will result in higher corporate profits in 2017 and/or 2018. Because the fat kats basically have insider informantion, stock prices always lead profit direction, both up and down.

To that end, the markets (Dow and S&P 500) both closed at all-time new highs on Friday, June 14th. Furthermore, the S&P 500 has not experienced even a -5% drawdown all year. From a seasonality standpoint, during the last 90 years, in 84% of the years that the market was up at least 8% in the first 1/2 of the year, it was followed by 4-5% gains in the 2nd half.

See below...

THE OTHER SIDE...

Regardless of the above, there is ample reason to believe that the market is ripe for a correction. Since 1950, the market has experienced at least a -5% drawdown in 91% of the years.

And there are indeed some real and far fetched possible reasons (failed Trump agenda, war with North Korea, Trump trouble with Russian collusion in the election, etc.) where the market could experience a real crash (-55% drop).

By and large, MIPS may or may not identify a -5% drop, but would almost certainly identify a "market crash" of 30-50% or more. In backtesting in 1987 and 2000, MIPS identified the drops and did not lose money in either crash. In actual trading in 2008 - 2009 (verified by TimerTrac.com), MIPS not only identified the -55% drop, but made over 100% to the upside!!!

MIPS3 during Oct 31, 2007 - March 31, 2009

Blue Line - MIPS +110%

Red Line - SPY - 50%

Red Dots indicate trade dates (from TimerTrac.com)

Paul Distefano, PhD

MIPS Timing Systems, LLC

Houston, TX

281-251-MIPS (6477)

|